What is Medigap, and Why Do I Need Supplemental Insurance?

What is Medigap, and Why Do I Need Supplemental Insurance?

Key Takeaways

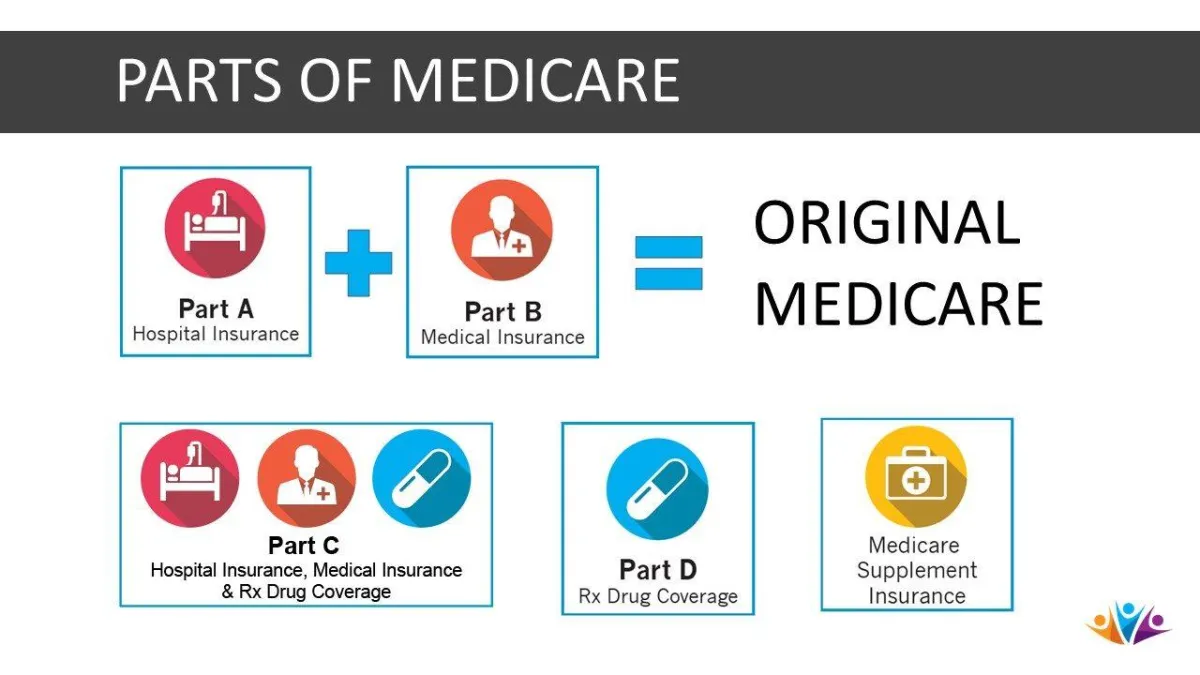

Private insurance companies offer Medicare Supplement insurance (Medigap) to help cover some of the healthcare costs not covered by Original Medicare (Part A and B).

You may need to add Medicare Supplement Insurance to fill costly “gaps” in coverage. Private insurance companies provide Medigap plans with different levels of coverage.

Medigap coverage can help you eliminate cost gaps. It’s important to know what you need and compare plans to determine which Medigap plan is right for you.

You can apply directly through a private Medigap provider, or through Marketplaces.

There’s nothing more personal than your health or finances; balancing both can be tricky. Original Medicare costs can add up quickly. By purchasing a Medigap policy, you are able to offset some of those costs. Continue reading to learn how Medigap works alongside Original Medicare.

What is Medigap Insurance?

Original Medicare (Part A and Part B) requires beneficiaries to still pay copays, deductibles, and coinsurance. Medicare Supplement Insurance, or Medigap policies, help you cover some of the costs Original Medicare doesn’t. Frequent hospital or doctor visits can be expensive without the right coverage.

A Medicare Supplement insurance plan offers:

Different coverage levels with standard benefits for each plan.

A range of services and plans, each assigned a letter from “A” to “N.” It’s important to note plans “E”, “H”, “I” and “J” are no longer sold.

Basic Medigap coverage is the same across most states and insurance companies.

Each Medigap plan follows federal and state laws to protect you and your policy.

The terms “standard benefits” and “basic coverage” mean that Medigap plan “A” in one state is the same as plan “A” in a different state. However, there are exceptions to this rule with a few states. We discuss these states below.

What Do Medigap Plans Cover?

Medicare Supplement plans cover some costs not covered by Original Medicare. For example, a 20% coinsurance bill for a doctor visit could be covered with a Medigap plan. All Medicare Supplemental insurance plans must cover standard services. Additional benefits are available with specific plans.

All Medicare Supplemental insurance plans must cover:

Medicare Part A coinsurance costs up to an additional 365 days after Medicare benefits run out; coinsurance or copayments for hospice care

Medicare Part B coinsurance or copayments

Up to three pints of blood

Other services covered depending on the plan:

Skilled nursing facility care coinsurance

Part A deductible

Part B deductible (no longer covered for new Medicare beneficiaries)

Part B excess charges

Foreign travel emergency care

Medicare Supplement plans generally don’t cover:

Prescription drugs

Vision

Dental

Long-term care

Hearing aids

Do you have more questions about Medicare Supplement coverage? Learn more.

Compare Medicare Supplement Plans

With 10 different plan options, it can be challenging to understand what each plan offers and whether it’s right for you.

We’ve created a chart for a side-by-side comparison of each plan. Any percentage less than 100% requires you to pay the remaining cost.

Necessary coverage Medigap policies are not the same if you live in Massachusetts , Minnesota, or Wisconsin.

There are a few important changes and variations of the plan that you should know before choosing.

Medicare Supplement Plan F and Plan G also offer a plan with a high deductible in some states. In 2024, you must pay $2,800 in shared costs before regular Medicare 80/20 policy begins.

As of January 1, 2020, new Medicare enrollees are not eligible for Plan C or Plan F. If you were eligible for Medicare before January 1, 2020, but did not enroll, you may still be eligible.

Medigap Plans K and L pay 100% of covered services after you reach the annual out-of-pocket limit and pay the yearly Part B deductible. Your annual out-of-pocket limit and Part B deductible reset each calendar year. In 2024, the Part B deductible is $240.

Medicare Supplement Plan N pays 100% of the Part B coinsurance with certain exceptions. For example, an office visit copay of $20 or $50 copay for emergency room visits that don’t include inpatient admission.

Learn more about Medigap plan costs and how to enroll.

Choosing a Medicare Supplement (Medigap) Policy

Is Medigap the right decision for you? Selecting a health insurance plan can be challenging. It’s important to compare each plan for your lifestyle because every Medicare Supplement plan is different.

Another option to consider is Medicare Advantage Plans (Part C). Those policies help with your Medicare costs and can add more benefits.

Sources

How to compare Medigap policies. Medicare.gov.

This website is operated by DereneDerricotte, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.