Is Medicare Advantage (Medicare Part C) Right for You?

Is Medicare Advantage (Medicare Part C) Right for You?

Key Takeaways

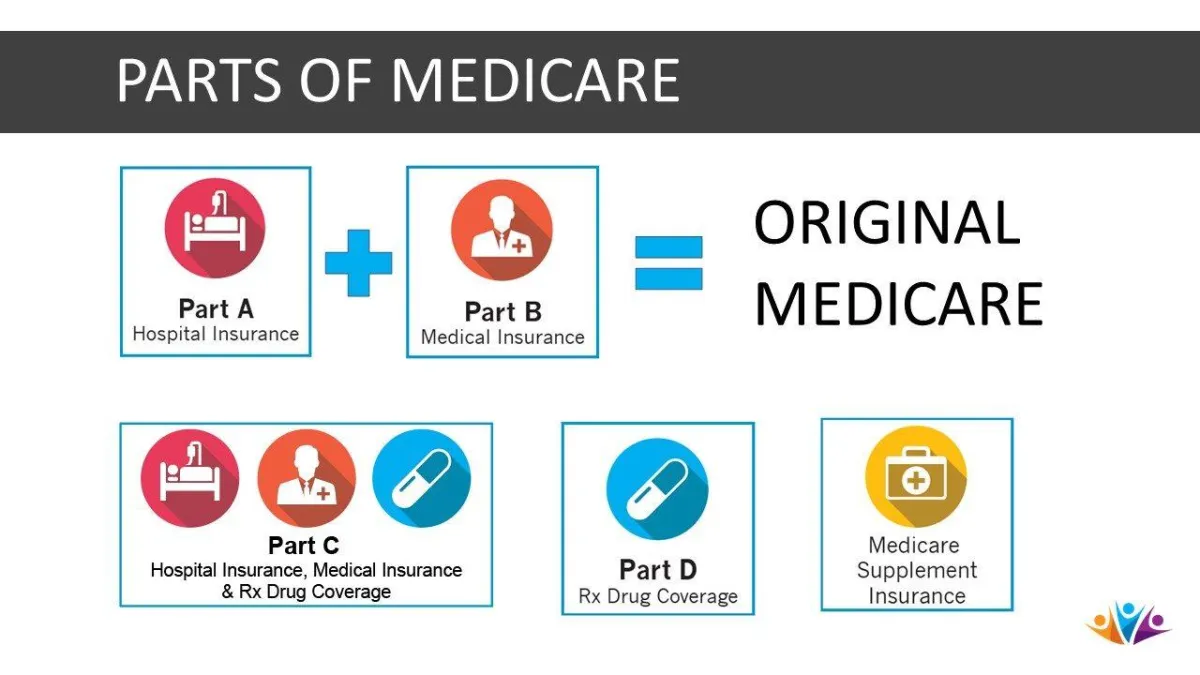

Medicare Advantage plans are private insurance and provide Part A and Part B coverage. Most Medicare Advantage plans include Part D along with dental, vision, and hearing benefits.

Medicare Advantage (Part C) replaces Original Medicare (Part A & B), but offers the same Part A & B benefits or coverages as Original Medicare. Along with receiving Part A & B benefits, Medicare Part C often bundles your benefits with additional ones like dental, hearing, vision, and prescription drug coverage.

Along with Medicare Parts A and B, most Medicare Advantage plans include Part D and extra health and wellness benefits. Most Medicare Advantage plans can offer lower monthly premiums and out-of-pocket maximums.

You can enroll through Marketplaces like GoHealth, private health insurance companies, or by mailing a paper application to the plan you want to join.

When you have Medicare Part C, your Part C benefits ID card replaces your Medicare “Red, White & Blue” card at every visit.

What Is Medicare Advantage?

Medicare Advantage (Part C) is private health insurance that complies with Medicare guidelines. Part C provides Part A and B coverage and extra health and wellness benefits, and most include a Part D prescription drug plan.

Whether you’re new to Medicare or looking to change your existing plan, we want to help you choose a plan to fit your lifestyle and budget.

If you or a loved one with Medicare benefits requires hospice care, it’s covered by Medicare.

What Do Medicare Advantage Plans Cover?

Medicare Advantage (Part C) replaces Original Medicare (Part A & B), but offers the same Part A & B benefits or coverages as Original Medicare. A high percentage of Medicare Advantage plans also offer extra benefits, including:

Additionally, most plans include prescription drug coverage (Medicare Part D).

Is Medicare Advantage Right for You?

Depending on where you live, it is likely that you’ll have several Medicare Advantage plans to choose from. It’s important to know your health needs before you compare your plan options. It’s essential that your doctors and prescriptions are covered in your Medicare Advantage plan. A GoHealth licensed insurance agent can help you compare plans to find one that meets your needs.

Is Medicare Advantage Better Than Original Medicare?

Medicare Advantage and Original Medicare offer Part A and Part B, but your health needs and location can affect the benefits you receive from each. Likewise, your costs can vary based on whether you choose a Medicare Advantage plan or Original Medicare. Here’s a look at some of the pros and cons of a Medicare Advantage plan.

Check out our guide on Medicare Advantage coverage to learn more about Part C.

Medicare Advantage vs. Medicare Supplement Plan (Medigap)

When Original Medicare misses out-of-pocket expenses like copays, co-insurance, and deductibles, Medigap (private insurance) will pay most of what’s left in the gap.

However, bundled benefits make Medicare Advantage (Part C) plans a popular choice. Most Medicare Advantage plans bundle Part A and Part B with Part D and extras benefits like vision, dental, and hearing.

Keep in mind, local/regional networks limit where you can use your Medicare Advantage plan. So if you like to travel around the U.S. during the year, Original Medicare with a Medigap plan may be the right choice for you.

One thing to keep in mind about Medigap and Medicare Advantage plans:

You cannot enroll in both plans. You must choose Original Medicare and add Medigap coverage or instead choose a Medicare Advantage plan.

Medicare Part C Costs

We can help you understand what costs are involved with each plan.

Let’s take a look at Part C cost information to consider:

There are several options when choosing a Medicare Advantage plan. Selecting the right plan for your needs is critical.

Typically, Medicare Advantage plans have a monthly premium but some Medicare Advantage Plans do not have premiums.

Don’t forget general healthcare costs when you select your plan. Typical cost factors include:

Annual deductible, copayment, co-insurance, and out-of-pocket maximum amounts of all services or needs.

Is your current provider in the plan’s network of providers? Call your provider to find out.

Consider your care plan and visit frequency.

Associated costs for additional needed benefits.

How Can I Enroll in Medicare Part C?

In order to enroll or switch to a Medicare Advantage plan, you must first be enrolled in Medicare Part A and Part B through Social Security. Then you should contact a private insurance company to enroll in Medicare Advantage, or you can enroll by mail after completing paper enrollment forms.

You can also contact a licensed insurance agent with GoHealth, who will walk you through the enrollment process and answer any questions about finding the right plan for you. Learn more about how to navigate Medicare Part C enrollment.

Sources

Medicare Advantage 2024 Spotlight: First Look. KFF.

This website is operated by DereneDerricotte, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.