Medicare Part A & B

Medicare Part A & B

Key Takeaways

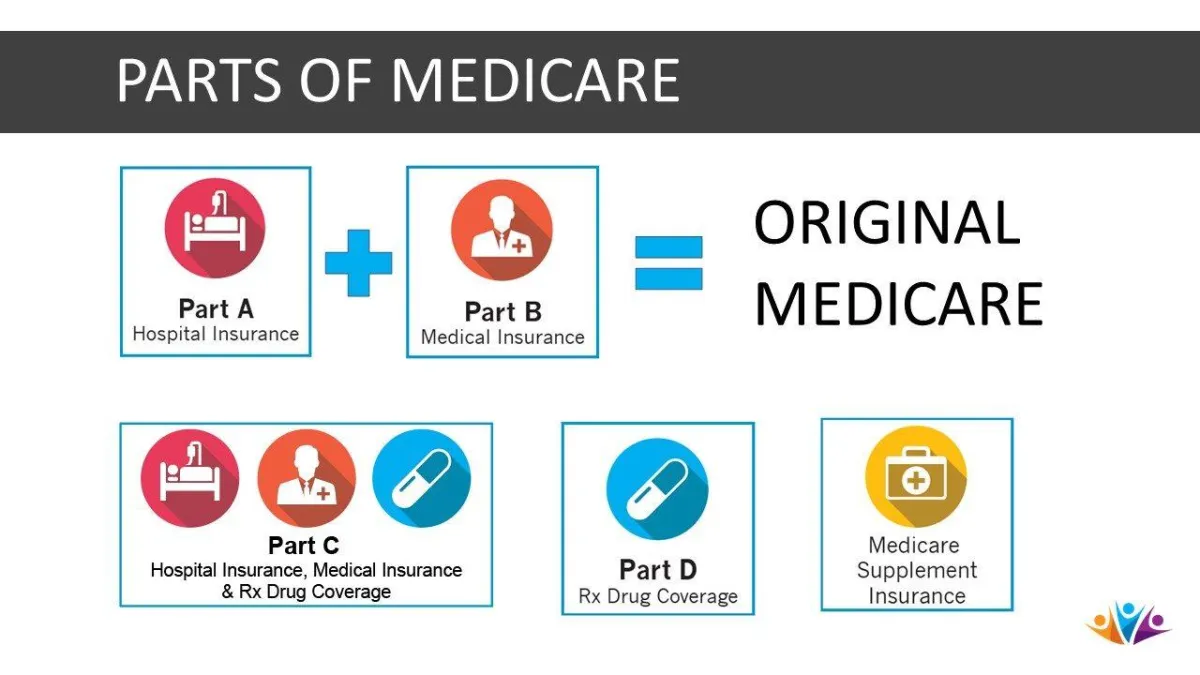

Original Medicare has two parts: Medicare Part A and Medicare Part B .

Part A and Part B provide hospital and medical coverage for individuals 65 years of age and older.

Medicare customers can see any doctor in the country that accepts Medicare.

You have a seven-month window when you turn 65 called your Initial Enrollment Period (IEP) to enroll in Original Medicare — the month of your birthday plus three months before and after your birthday month. If you miss your IEP, you’ll need to wait for the Annual Enrollment Period.

What Is Medicare?

With more than 60 million Medicare enrollees in the country, you, or someone you know, receive Medicare benefits. If you or a loved one will soon be eligible for Medicare, and have questions, we have answers.

Medicare: The Basics

Medicare is public health insurance for Americans who:

Are 65 years of age or older.

Are younger than 65 years of age but have qualifying disabilities .

The Medicare insurance program is run by the Centers for Medicare & Medicaid Services (CMS). The program is funded partially by the federal budget, income taxes paid to Social Security and Medicare, and premiums paid by Medicare beneficiaries. Original Medicare (Part A and Part B) insurance can be used at any doctor or hospital in the U.S. that accepts it.

The most popular form of Medicare is Original Medicare, which is Parts A and B only. That’s why it’s the best place to start.

What's Covered by Medicare?

Medicare Part A and Medicare Part B cover most standard medical services. Part A and Part B cover facility costs and Medicare-approved services you receive inside. You may hear Part A called hospital insurance and Part B called medical insurance.

Between Parts A and B, Original Medicare covers a wide range of services. For a deeper look into what you can expect from your Medicare policy, check out our information on Original Medicare Parts A and B coverage. GoHealth can also help you with options like Medicare Supplement Insurance (Medigap) and Medicare Advantage.

How Much Do Medicare Part A and B Cost?

For most people, their budget is front and center when considering which health insurance to choose. Here’s a starting point when working out your budget:

The standard premium for Medicare Part B is income-based. For both Part A and Part B, after you meet your deductible, your cost for care will be approximately 20%, and Medicare will pay about 80% for the remainder of your benefit calendar year.

There are plenty of other factors to consider, including copayments , coinsurance, and when to enroll. Learn more about what goes into Original Medicare costs.

How Do I Get Original Medicare?

You know what’s included in Original Medicare and what it covers. How do you enroll in Original Medicare? Most Americans are automatically enrolled in Part A when they reach 65 years of age.

You must contact the Social Security Administration to enroll in Part B if you’re already enrolled in Part A. You can enroll online if you actively sign up for both Parts A and B at the same time.

Because you pay a premium for Part B coverage, you can turn down the coverage. If you turn down Part B coverage but choose to enroll later, you may have to pay a higher monthly premium.

When Can I Add Part D Coverage?

Understanding that you will need to add Medicare Prescription Drug Plan (Part D) coverage is essential. Medicare Prescription Drug coverage (Part D) is added to Original Medicare. What does that mean? Here are two important details to help explain:

Part D is an optional Medicare benefit. It’s recommended if you think you’ll need prescription medication in the future or currently depend on prescriptions to manage your health.

Private health insurance companies administer Part D. The federal government sets specific requirements, but private health insurance companies decide which drugs to cover.

To join Part D, you can choose a Prescription Drug Plan (PDP) or a Medicare Advantage plan that includes drug coverage (MA-PD). You can add Part D coverage during any of the Medicare enrollment periods.

When Am I Eligible To Enroll In Medicare?

The majority of Americans that choose Medicare health insurance plans are 65 years of age or older. If that’s you, you’ll want to remember the seven-month rule, which says that you have seven months to enroll in Medicare during the year you turn 65.

For example, if you turn 65 in August:

Three months before your birth month: May, June, July

Your birth month: August

Three months after your birth month: September, October, November

For some people with specific disabilities and illnesses, Medicare is available before they reach 65 years of age. If you’re an American citizen, or have lived in the U.S. legally for five or more years, you’re eligible for Medicare if any of the following apply to you:

You’re 65 years of age or older.

You’ve received Social Security disability benefits for more than 24 consecutive months.

You’ve received disability benefits from the Railroad Retirement Board for more than 24 consecutive months.

You have kidney failure, also known as end-stage renal disease, requiring permanent dialysis or need a kidney transplant.

You’re living with Amyotrophic Lateral Sclerosis (ALS), also known as Lou Gehrig’s disease.

Is Medicare the Right Choice For You?

Here’s a recap of Original Medicare, its costs, how to enroll, and what it covers:

Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance).

If you want prescription drug coverage, you can join a separate Part D plan with a private health insurance provider.

To help pay your out-of-pocket costs in Original Medicare (like 20% coinsurance), you can also explore supplemental coverage.

You can use any doctor or hospital that accepts Medicare, anywhere in the U.S.

Original Medicare is one way to get Medicare. The other way is Medicare Advantage. We recommend you also take time to learn about Medicare Advantage, Medigap, and out-of-pocket costs. These are all important pieces of making the best decision for your care. You can always contact a Derene Derricotte LLC licensed insurance agent to get answers. Serene Derricotte LLC works for you, not insurance companies, and will take time to discuss all your options.

Sources

Fast Facts. CMS.gov.

Medicare costs at a glance . Medicare.gov.

Medicare Benefits . SSA.gov

How Medicare Works With Other Insurance . Medicare.gov

This website is operated by DereneDerricotte, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.