Medicare Part D Prescription Drug Coverage: What Is & Isn't Covered

Medicare Part D Prescription Drug Coverage: What Is & Isn't Covered

Key Takeaways

Medicare Part D is private insurance that covers generic and brand-namedrugs

Your Medicare Part D coverage depends on your policy and how your insurer classifies the drugs you need, among other things

Part D coverage has rules to ensure medication is safe and necessary

While Medicare Prescription Drug Plan (Part D) is drug coverage for all Medicare beneficiaries, not all prescription drugs are covered equally. On this page, we’ll help answer some vital Part D questions. What is Medicare Part D coverage? What drugs are covered by Medicare Part D? What are drug tiers?

Need info on Medicare prescription drug benefits? GoHealth has everything you need to know about Medicare Part D drugs covered here.

What Does Medicare Part D Cover?

Medicare Part D offers prescription drug plans that cover both generic and brand-name drugs. Each policy has a standard level of coverage and its formulary lists. Prescription drug costs and availability may vary based on your Part D plan, insurer and location. All plans must offer the same drug categories, but drug brand names vary based on the formularies.

You can get Medicare Part D coverage by:

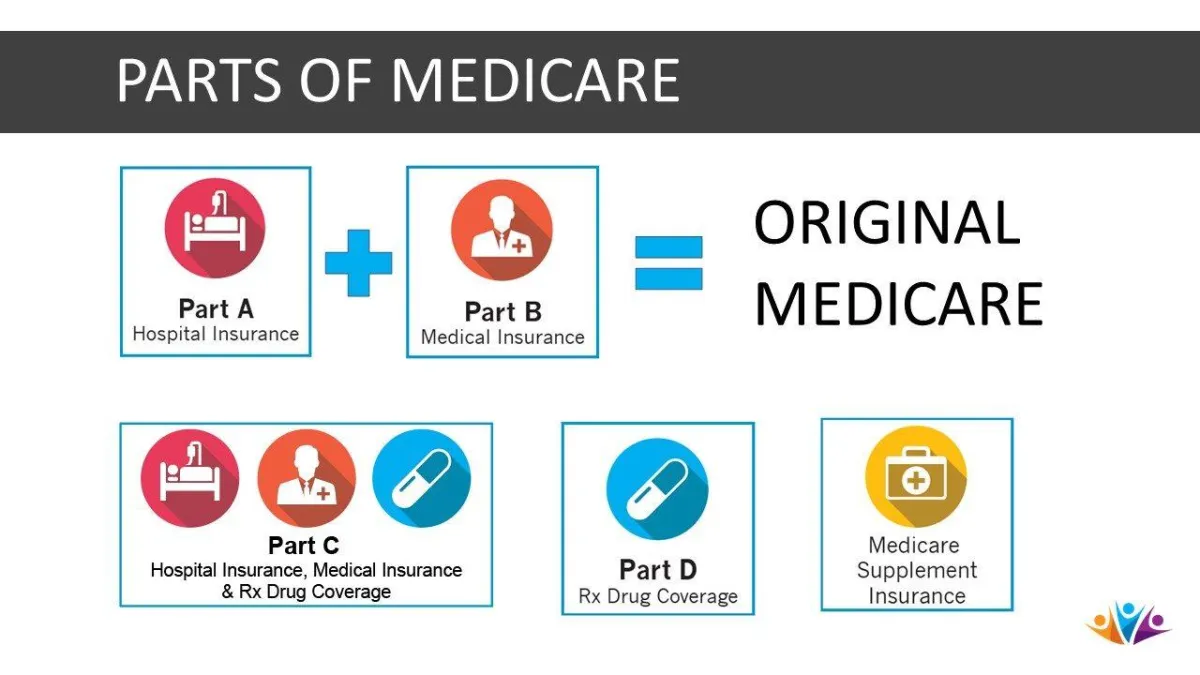

Adding standalone Medicare Part D coverage to your Original Medicare (Part A and B)benefits

Enrolling in a Medicare Advantage plan that includes Part A, B and D

The Rules: What Does Medicare Part D Coverage Mean for You?

Some Medicare Part D plans have specific coverage rules to ensure safety with your prescriptions. For this reason, there are some guidelines around Medicare Part D coverage you’ll want to know about:

Prior authorization

Drug use and safety rules for some medications require prior approval and documentation before Part D will cover it. You can apply for an exception if your healthcare provider believes you must be on that medication.

Step therapy

Some Part D plans require you to try a generic or less expensive drug on their formulary before going up a “step” to brand-name or more costly drugs.

You can request an exception through your plan if your healthcare provider believes:

You need the more expensive drug for medical reasons.

You may experience adverse side effects from the less expensive drug.

The less costly drug could be less effective for your condition.

Quantity limits

There may be a limit on the number of drugs covered over a period of time for some Part D plans. This could mean you can only get a 30-day supply for certain prescriptions. However, your healthcare provider can request an exception if you need a higher dosage.

What Drugs Does Medicare Part D Cover?

There are standard drug types that all Part D prescription coverage plans must offer. By law, there must be at least two Medicare Part D drugs covered in most categories.

Medicare Part D coverage also must cover nearly all types of medication in the six most essential categories:

Antipsychotics

Antidepressants

Anticonvulsants (for seizure disorders)

Immunosuppressants

Cancer drugs

HIV/AIDS drugs

Part D coverage must include all commercially available vaccines unless covered under Medicare Part B. You can find the full list of vaccines covered by Part D in your plan’s drug list. There may be additional costs based on the type of vaccine and where you receive it.

Which Medication Would Not be Covered Under Medicare Part D?

Like Part A and B benefits, Medicare Part D covers medications that your doctor and insurance company deem medically necessary. That means Part D prescription coverage plans generally do not cover medications for:

Weight loss or weight gain

Cosmetic purposes (including hair growth)

Fertility purposes

Over-the-counter drugs

Drugs for erectile dysfunction

Drugs covered by Original Medicare (Part A and B)

Does Medicare Part D Cover My Prescriptions?

Medicare Part D organizes different prescription drug lists by “tiers.” The tiers generally represent different costs, ranging from the lowest copays to the highest.

What Would Medicare Cover if I Didn’t Have Medicare Part D?

Part A and Part B offer minimal prescription drug coverage. Part B covers drugs administered in an outpatient or medical setting. These can include different injectable drugs and medications used with durable medical equipment. Drugs you can take yourself, with a few exceptions, tend to fall under the standard Part D guidelines spelled out above.

Coverage Choices

You have a choice when selecting your prescription drug plan. Gather all the information you need, including your medications and doses, before you start comparing plans.

Ask yourself the following questions:

Which plans cover the prescription drugs I need?

How much will my monthly premiums, annual deductible, and coinsurance or copayments be?

Which plan offers the best price for all of my medications?

Which pharmacies are in-network?

Will there be a late enrollment penalty because I waited to join?

Medicare Part D Coverage Gap & Donut Hole

Few things can gum up your Medicare Part D coverage like not understanding how to pay for your prescriptions. Part D has a unique deductible structure that includes an Annual Deductible, Initial Coverage, Coverage Gap (donut hole), and Catastrophic Coverage. Knowing what they are and how they work will let you know what to expect from your Part D payments.

Sources

Your Guide to Medicare Prescription Drug Coverage. Medicare.gov.

Prescription drugs (outpatient). medicare.gov

This website is operated by DereneDerricotte, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.