Medicare Part C Coverage: What Does It Cover?

Medicare Part C Coverage: What Does It Cover?Key Takeaways

Along with receiving Part A & B benefits, Medicare Part C often bundles your benefits with additional ones like dental, hearing, vision, and prescription drug coverage.

The two most popular choices of plans are Preferred Provider Organization (PPO) and Health Maintenance Organization (HMO).

If your provider is in-network, you can save money and gain additional health and wellness benefits.

You can enroll in Medicare Advantage during any of the Medicare enrollment periods. If you’re in the Initial Enrollment Period, you must have joined Part A and Part B before selecting a Medicare Advantage plan.

Are you having trouble choosing the best coverage? Let’s review the Medicare Advantage (Part C) coverage

What Does Medicare Part C Cover?

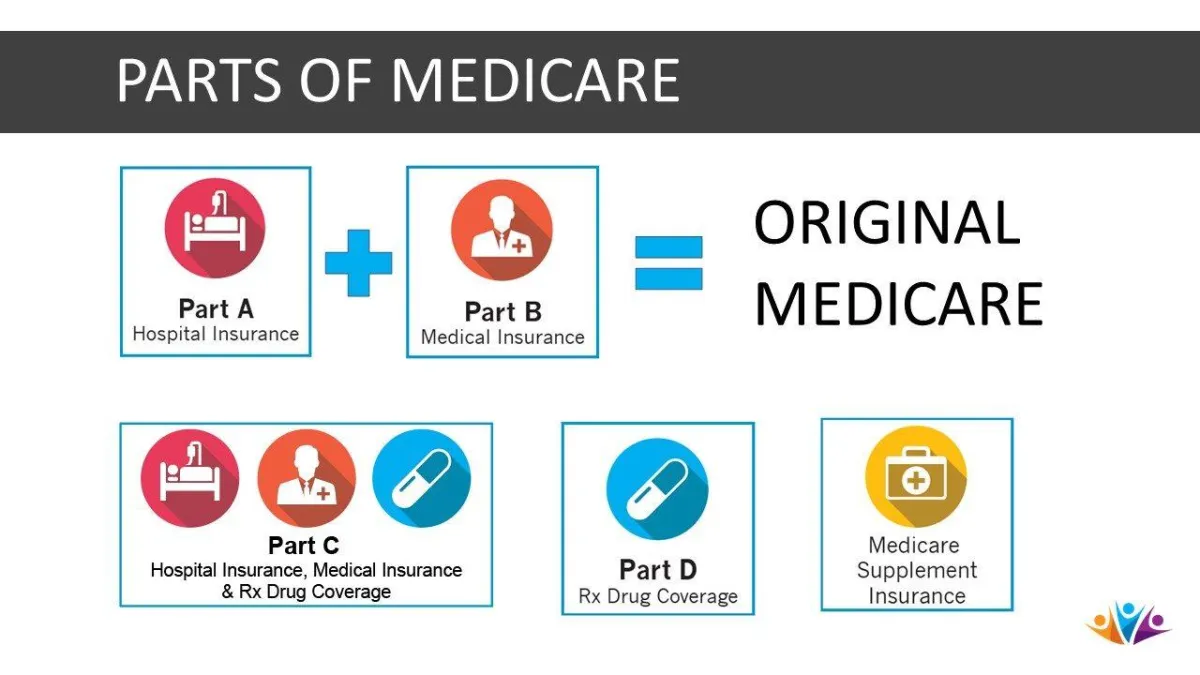

Medicare Advantage (Part C) replaces Original Medicare (Part A & B), but offers the same Part A & B benefits or coverages as Original Medicare. Along with receiving Part A & B benefits, Medicare Part C often bundles your benefits with additional ones like dental, hearing, vision and prescription drug coverage.

When you have Medicare Part C, your Part C benefits ID card replaces your Medicare ‘Red, White & Blue’ card at every visit.

You can still join a Medicare Advantage plan even if you have pre-existing conditions .

Why Is Medicare Part C Separate?

Medicare Advantage plans are not separate from Medicare. Medicare Advantage (Part C) is private insurance required to meet all of Medicare’s regulations. You have Medicare rights and protections, even though private insurance companies manage your benefits. Medicare Advantage plans can offer additional benefits like Part D, vision, dental and hearing.

Does Medicare Advantage Require Use of In-Network Services?

Medicare Advantage Plans aren’t as flexible as Original Medicare policies. Many plans only cover costs if you visit providers within their network. Health Maintenance Organization (HMO) plans generally offer narrower primary care networks, while Preferred Provider (PPO) plans are broader.

What are the Different Types of Medicare Part C Plans?

Medicare Advantage (Part C) plans vary on a state-by-state, even county-by-county basis. Let’s take a look at the two most popular choices:

Preferred Provider Organization (PPO)

All Part C plans have a provider network, but PPO offers the flexibility to visit an out-of-network provider that accepts Medicare.

In-network providers are affordable.

You are not required to choose a primary care doctor.

Health Maintenance Organization (HMO)

You must see an in-network provider unless you need emergency care.

Choosing a primary care doctor is a requirement.

Plans may require a referral or prior authorization for specialists, and some tests and procedures.

Most plans include prescription drug coverage (Part D).

Additional Part C options include:

Special Needs Plans (SNPs)

Medicare Medical Savings Account (MSA) plans

Private Fee-for-Service (PFFS) plans

Sources

Most Medicare Advantage Plans Offer Broad Primary Care Provider Networks. CMS.gov.

This website is operated by DereneDerricotte, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.