Medicare Part A Costs for 2024

Medicare Part A Costs for 2024

Key Takeaways

Medicare Part A provides hospital coverage to U.S. citizens age 65 and older and doesn’t carry a monthly premium if you’ve worked at least 10 years.

You also won’t pay a Part A monthly premium if you already receive retirement benefits from Social Security or the Railroad Retirement Board when you enroll.

For qualified hospital stays lasting 60 days or fewer, Part A pays all hospital-related charges after you pay the deductible ($1,632 in 2024).

Days 61-90 require you to pay hefty daily coinsurance, and the cost increases if you extend beyond Day 90 and into your 60 lifetime reserve days.

A Medigap policy added to Parts A and B of Original Medicare , or a Medicare Advantage plan that replaces Parts A and B can help control out-of-pocket costs and extend the length of coverage.

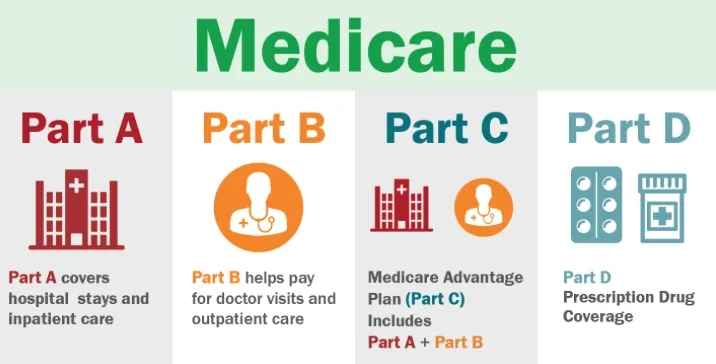

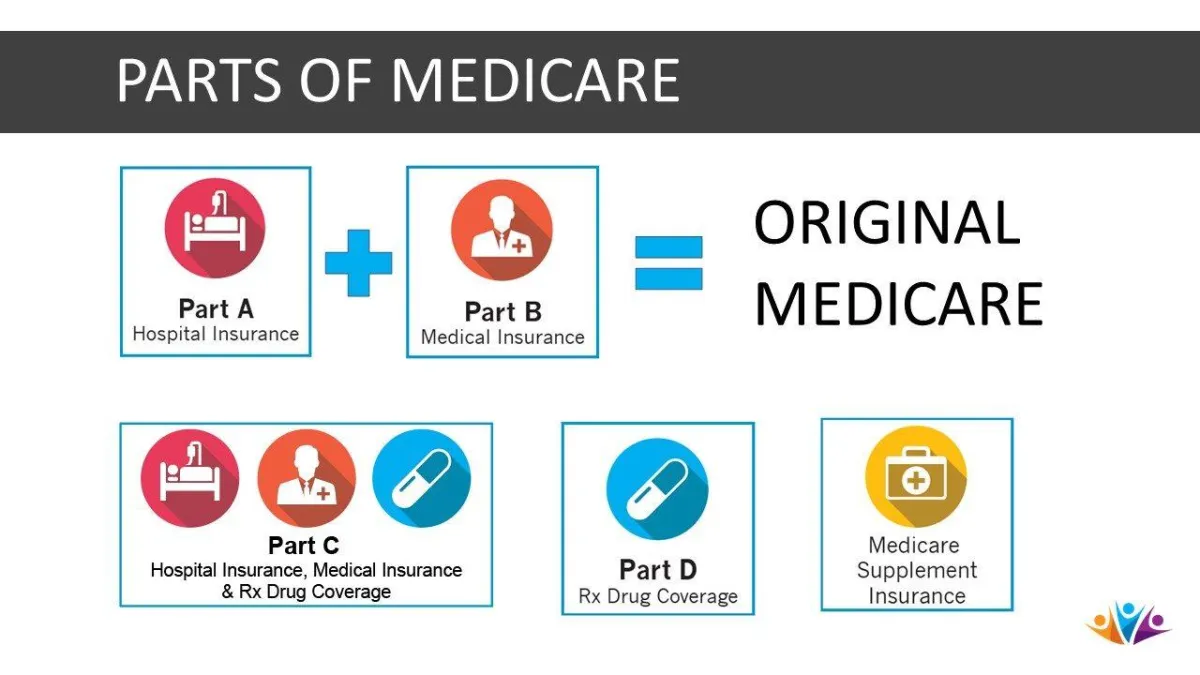

Medicare Part A, commonly referred to as hospital insurance, covers most inpatient services. To be eligible for Medicare Part A, you must be a U.S. resident age 65 or older. To qualify for Medicare Part A with no monthly premium, you must have paid Medicare taxes through employment for at least 10 years.

If you or a family member have spent time as a patient in the hospital, then you know it gets expensive the moment you walk in the door. Medicare Part A pays a portion of what often are massive bills resulting from a stay in the hospital. In the simplest terms, after you pay the deductible associated with a qualifying hospital stay, the hospital portion of your bill is covered for the first 60 days.

Not everything is simple when it comes to Medicare Part A costs.

Do I Have To Pay for Medicare Part A?

A small percentage of people have to pay a Medicare Part A premium. In fact, 99% of Medicare beneficiaries do not pay a Part A premium, according to CMS. Most people don’t have to because, by the time they turn 65, they have paid Medicare taxes through employment for at least 10 years. If you reach 65 and haven’t paid 10 years of taxes, you also can avoid the Part A premium if you have a spouse (or ex-spouse) who is at least 62 years old and has paid 10 years of employment taxes.

How Much Does Medicare Part A Cost per Month?

For 2024, the Part A premium is $505 per month if you have paid Medicare taxes for fewer than 30 quarters. If you have paid taxes between 30 and 39 quarters, the monthly premium is $278.

Do Medicare Part A Costs Go Up or Down From Year to Year?

You should always review the costs associated with your plan each year. It’s common for costs to increase year over year, and while the increases historically haven’t been significant, over time they can add up.

Are you a Medicare beneficiary paying the Part A monthly premium?

If you’re paying a monthly premium, you should plan for your premium to increase each year. You can look at the increases over past years to get an idea of what you can expect.

To factor the big picture costs of your coverage accurately, you should take a look at Part A deductible and coinsurance costs the same way. These costs can, and usually do, rise each year the same as premiums.

Are you a Medicare beneficiary who receives premium-free Part A coverage?

You may not pay the Part A premium, but don’t expect your costs to remain the same each year. The Part A deductible and coinsurance can and usually do increase each year.

If you want to be financially prepared for an emergency, you should know your deductible and coinsurance costs each year.

If you’re interested in finding more information about the costs trends of Medicare Part A coverage, you have options. You can contact a GoHealth licensed insurance agent to compare costs and help you plan for managing your benefits accordingly. In addition, Medicare.gov provides an annual snapshot of fees each year.

How Much Does Medicare Part A Cost in 2024?

While most people get Part A of Original Medicare without paying a monthly premium, those who use their Part A coverage are responsible for some costs.

Suppose you stay in the hospital for 60 days or less. In that case, Medicare pays for all of your hospital-related charges for the inpatient stay after paying the benefit period deductible, which is $1,632 in 2024. While most forms of insurance feature an annual deductible, Part A has a deductible every time you have a hospital stay.

If your stay lasts between 61 and 90 days, you pay $408 of daily coinsurance beginning on Day 61.

If your stay extends beyond 90 days, you pay $816 of coinsurance for up to 60 “lifetime reserve days.” Lifetime reserve days can be used over multiple benefit periods. Once your lifetime reserve days are exhausted, Part A doesn’t provide any coverage.

You can extend your Part A coverage beyond your lifetime reserve days and get some or all of your coinsurance responsibilities covered by adding a Medigap plan. Also known as Medicare supplement insurance, Medigap is private health insurance that supplements your coverage and helps with your healthcare costs.

You must have Part A and Part B of Original Medicare to add a Medigap plan. When you enroll in Part B the month you turn 65, you have a Medigap Open Enrollment Period that lasts six months. During this open enrollment, pre-existing conditions cannot prevent you from getting coverage, nor can they be used to increase premium costs.

All 10 of the standard Medigap plans offered by private insurance companies supplement your Part A coverage by paying 100% of coinsurance beginning with Day 61 of a hospital stay and extending that coverage for up to 365 days after you exhaust your lifetime reserve days. Some Medigap plans also cover the Medicare Part A deductible.

If you live in Wisconsin, Minnesota, or Massachusetts, your Medigap plan is not the same as other states. In most cases, a Medigap plan purchased in Illinois is the same if you find yourself in Texas. It’s standard. However, your Medigap plan is not standard if you live in Wisconsin, Minnesota, or Massachusetts.

Another way to control out-of-pocket costs related to a hospital stay is to switch to a Medicare Advantage plan. Medicare Advantage plans, which replace Parts A and B of Original Medicare while offering at least the same coverage as Parts A and B, must have an annual out-of-pocket maximum.

How does an out-of-pocket maximum potentially protect you? Let’s say you have Original Medicare coverage, which does not have an out-of-pocket maximum. Your share of medical costs after you reach deductible is 20% of all Medicare-approved services. Without an out-of-pocket maximum, your cost of care can rise significantly because no matter how steep the bill, you are responsible for 20%.

With a Medicare Advantage out-of-pocket maximum, you may still be responsible for 20% of costs but only until you reach a predetermined amount — your out-of-pocket maximum. At that point, your plan covers 100% of Medicare-approved services.

The specifics of your Medicare Advantage plan will dictate how much you will pay for a hospital stay.

Medicare Part A Coverage and Enrollment

Now that you understand the costs associated with Medicare Part A, it’s helpful to learn more about Part A coverage before proceeding to the enrollment process.

What Does Medicare Part A Cover Exactly?

Medicare Part A covers most of your inpatient services and a few others. While commonly known as “hospital insurance,” Part A provides coverage outside of what you think of as a traditional hospital. In general, Medicare Part A will cover most but not all of your costs after you’ve reached your deductible amount. Here are a few Part A examples:

Inpatient care in a hospital

Skilled nursing facility care

Nursing home care, as long as it’s not custodial or long-term care.

Hospice care

Some home health care

How to Enroll in Medicare Part A

If you believe you would benefit from Part A coverage and qualify for it, the final step is the Part A enrollment process. For someone approaching age 65, the Initial Enrollment Period (IEP) is crucial. Your Initial Enrollment Period is three months before and after your birthday month. So, you have a total of seven months to enroll the year you turn 65.

Also, if you’re newly eligible for Medicare but have been drawing benefits from Social Security before your Medicare eligibility, you may be automatically enrolled in Part A. In this case, you should receive a notification in the mail from the Social Security Administration (SSA).

Sources

Medicare Costs . Medicare.gov.

Medicare Part A and Part B Eligibility and Enrollment . CMS.gov.

Are You a Hospital Inpatient or Outpatient? Medicare.gov.

This website is operated by DereneDerricotte, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.