Medicare Part A Enrollment: How to Enroll

Medicare Part A Enrollment: How to Enroll

Key Takeaways

Medicare Part A provides hospital coverage to U.S. citizens age 65 and older and doesn’t require a monthly premium if you have worked at least 10 years.

You are automatically enrolled leading up to your 65th birthday if you begin receiving Social Security benefits at least four months before you turn 65.

If you aren’t automatically enrolled, you can apply online, over the phone or by visiting your local Social Security Association office.

If you qualify for Part A without a monthly premium and didn’t enroll at age 65, you can get up to six months of retroactive coverage.

Most U.S. citizens first qualify to enroll in Medicare Part A — commonly referred to as hospital insurance — when they turn 65 years old. Some people are automatically enrolled at 65, but many have to take action to enroll.

You can enroll online or over the phone with the Social Security Administration, or by visiting your local SSA office.

GoHealth has all the information you need about Medicare Part A enrollment.

Are You Automatically Enrolled in Medicare Part A When You Turn 65?

You must be receiving Social Security benefits or Railroad Board benefits for at least four months prior to your 65th birthday in order to be automatically enrolled in Medicare Part A when you turn 65. Otherwise, you will have to apply for benefits.

From the beginning of the Medicare program in 1965 until the dawn of the 21st century, the timelines for Social Security and Medicare were in step with each other. You were able to receive full Social Security retirement benefits at age 65, and your Medicare Part A and/or B monthly premiums were deducted from your Social Security check.

Beginning in 2000, however, the Social Security Amendments of 1983 took effect and began a gradual process of pushing back the standard age for full Social Security benefits. Citing increased life expectancy and improvement in the health of older adults, the legislation started a 22-year clock pushing the standard age for receiving full Social Security benefits to age 67 beginning with people born in 1960.

With the changes adding up to many people waiting until after age 65 to draw Social Security, automatic enrollment has become less common. Automatic enrollment triggered by Social Security (or Railroad Board) payments now happens only if you begin receiving payments at least four months before you turn 65.

Here’s why — and why not being automatically enrolled may actually be a blessing.

The standard age for Medicare eligibility remains 65, and the time frame for first enrolling in Medicare is your seven-month Initial Enrollment Period, which includes the three full months before you turn 65, the month you turn 65 and the three months after you turn 65.

For you to be able to start Medicare coverage on the first day of your birth month, you must apply during the three months before your birth month. Automatic enrollment follows that timeline, so if you are automatically enrolled you receive a “Welcome to Medicare” kit about three months before you turn 65. In order for that timeline to work, you have to be receiving Social Security before the time arrives for your packet to go out in the mail.

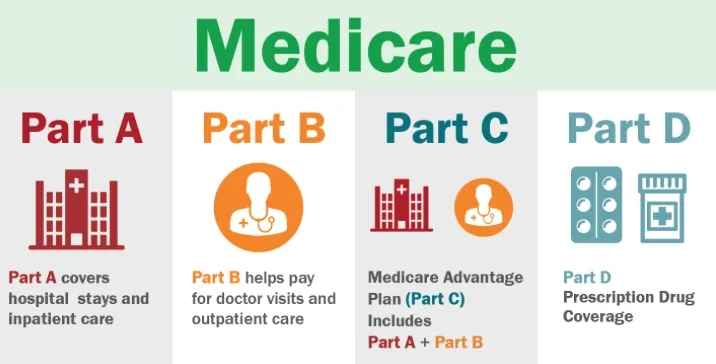

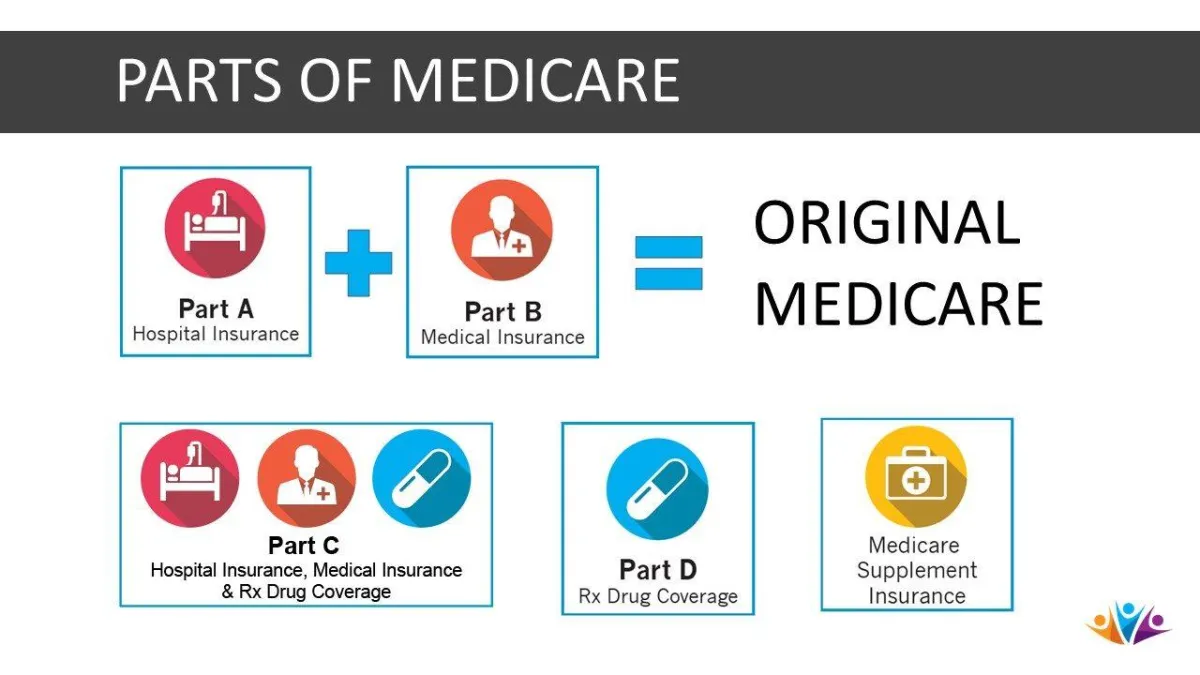

While it can make things easier for you if you’re automatically enrolled, it could actually complicate things. Here’s why. Those who are automatically enrolled are enrolled in both Part A and Part B. While nearly everyone takes advantage of Part A at age 65 because it provides hospital insurance with no monthly premium if you have worked at least 10 years. People with employer insurance may opt out of Part B enrollment at age 65 because it provides similar medical insurance with a monthly premium.

So if you are automatically enrolled in Original Medicare — Parts A and B — you may want to decline Part B, depending on your needs. If you aren’t automatically enrolled, then you only have to go through the enrollment process for the part (or parts) of Medicare you want.

How Do I Sign Up For Medicare Part A Only?

You have the same options for signing up for Part A, Part B or both:

Enroll online with the Social Security Administration.

Visit a local Social Security office.

Call 1-800-772-1213 (TTY: 1-800-325-0778).

You can enroll in Part A only, but you must have both Parts A and B of Original Medicare to add a Medigap Supplement (Medigap) plan. Having both Parts A and B also is required for enrollment into a Medicare Advantage plan. In addition to covering Parts A and B, Medicare Advantage plans may cover things like out-of-pocket maximums, dental, vision, hearing coverage and often prescriptions.

Can You Enroll in Medicare Part A Anytime?

If you qualify for Part A with no monthly premium, the short answer is yes, but the ability to enroll anytime will be more limited if you also want to enroll in Part B and you missed your Initial Enrollment Period. When it comes to Medicare Part A enrollment alone, you do not need to wait for a specific enrollment period; you can enroll anytime during or after your IEP. When you apply for the first time, you will get retroactive coverage for up to six months, but no earlier than the first month you were eligible for Medicare.

It makes sense to enroll in Part A during the first three months of their Initial Enrollment Period so that your coverage will start on the first day of the month that you turn 65. However, if you missed that window, Part A coverage will be retroactive to the first day of the month you turned 65 if you enroll in Part A during your birthday month or during the five months that follow your birthday month. The six months of retroactive coverage also applies if you enroll even later, but obviously, the coverage wouldn’t date all the way back to the month of your 65th birthday.

If you want to enroll in both Parts A and B (or if you have to pay a premium for Part A, in which case you are required to enroll in Part B as well), you must do so during your Initial Enrollment Period or a subsequent period. After your Initial Enrollment Period, Medicare enrollment would be limited to:

The General Enrollment Period and the Open Enrollment Period are available at the same time, from January 1 to March 31 each year.

A Special Enrollment Period triggered by, for example, the loss of employer health insurance.

When Must I Sign Up for Medicare Part A?

If, like most people, you are eligible for Medicare Part A with no monthly premium, you can sign up leading up to your 65th birthday or at any age after. If you don’t have to pay a Part A premium, however, there is no downside to enrolling once you’re eligible because Part A may help even if you have employer coverage.

If you have to pay for Part A because you haven’t worked at least 10 years, then waiting until you’re after 65 could cost you more if you still haven’t worked 10 years when you eventually do enroll. A 10% late enrollment penalty will be added to your premium for every year after age 65 that you delay, and you’ll have to pay the penalty for two times as many years as you delayed. So if you don’t qualify for a Special Enrollment Period and you sign up three years after you turn 65, you will have a 10% penalty added for each of those three years and will have to pay the higher premium for six years.

Now that you understand the ins and outs of Medicare Part A enrollment, it’s helpful to learn more about Part A coverage and costs before enrolling.

How Much Does Medicare Part A Cost?

Most people don’t have to pay a monthly premium for Part A, but there are costs related to Part A like deductibles and coinsurance.

What Does Medicare Part A Cover Exactly?

While commonly known as hospital insurance, Part A provides coverage outside of what you think of as traditional hospital coverage, too.

Sources

Increase in Retirement Age . SSA.gov.

Apply for Benefits . SSA.gov.

Social Security Office Locator . SSA.gov.

Ready to sign up for Part A & Part B . Medicare.gov.

This website is operated by DereneDerricotte, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.