Does Medicare Cover Palliative Care?

Does Medicare Cover Palliative Care?

Key Takeaways

If you are diagnosed and living with a terminal illness while on Medicare, your palliative care is covered.

Palliative care and hospice are not the same things. Palliative care acts like an umbrella, while hospice is care you can elect when you receive an end-of-life diagnosis and stop treatment.

If you’re receiving hospice care while receiving treatment for an illness, you typically receive two 90-day benefit periods followed by unlimited 60-day periods as long as recommended by your doctor.

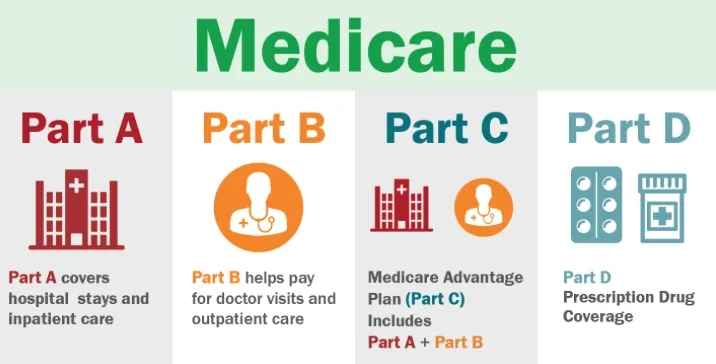

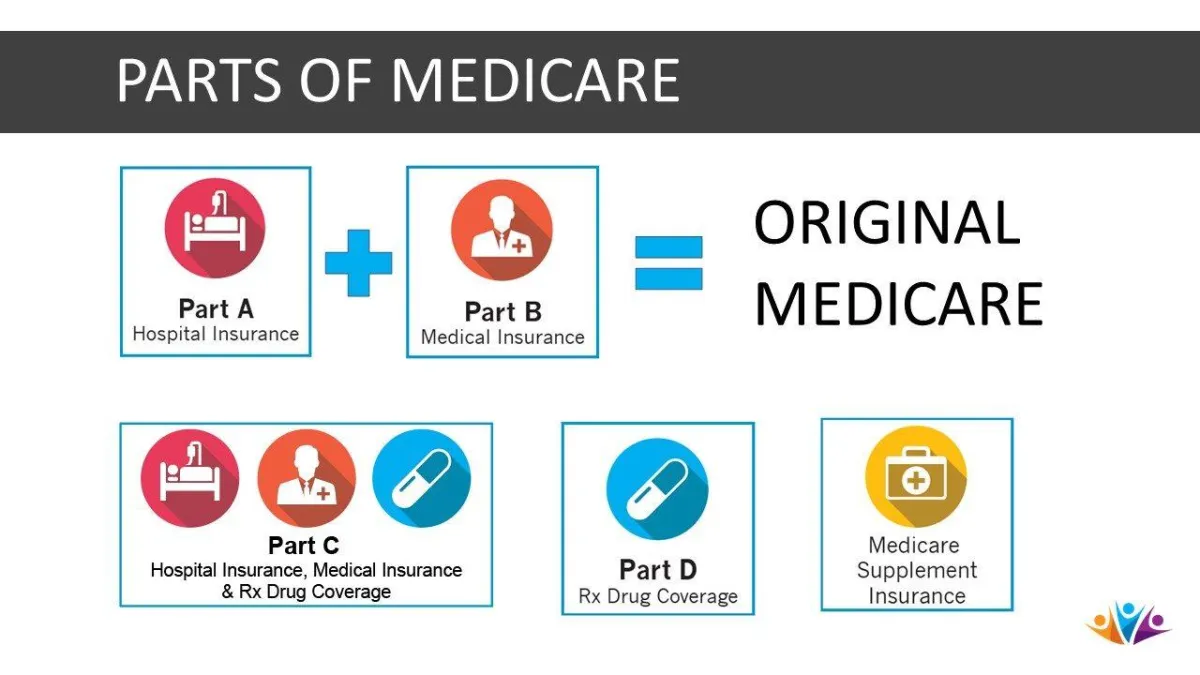

Medicare does cover palliative care, with different Medicare plans covering different aspects of treatment. Parts A, B and D of Original Medicare will cover palliative care that aligns with each part’s typical coverage. Medicare Advantage plans offer Part A and B coverage at the minimum but typically offer prescription coverage similar to Part D in addition to other coverages that go beyond Original Medicare.

What is Palliative Care?

Palliative care is a developing medical specialty focused on providing a sense of comfort and control to people dealing with a serious illness. It aims to manage many medical and personal aspects of care to reduce suffering and improve well-being.

At one end of the spectrum, palliative care may come in the form of medication administered to make the final days of someone’s life as comfortable as possible. Or palliative care may take the form of a mental health visit for someone who has just learned they have a treatable form of cancer.

Palliative care vs. hospice care and Medicare

While you can choose to receive palliative care while also receiving treatment for a serious illness, hospice care is palliative care without treatment of the illness.

Medicare covers hospice care if a doctor states that you have less than six months to live because of a terminal condition.

What Qualifies You for Palliative Care?

While Medicare only uses the term “palliative care” as it relates to coverage for hospice, you can receive palliative care alongside treatment for your serious illness as long as it is something that Medicare typically covers.

Suppose you are diagnosed with a severe illness, such as cancer, congestive heart failure or Alzheimer’s disease. In those cases, your doctor may suggest you begin palliative care alongside your treatment. Tools that may be suggested to help you could include:

Doctor and nursing care services (Part A).

Prescription drugs for symptom or pain relief (Part D).

Medical equipment and supplies (Part B).

Special services such as physical or occupational

therapy, social work, nutritionist counseling and grief counseling (Part B).

Even though your doctor put together a treatment plan that he referred to as “palliative care,” Original Medicare and Medicare Advantage plans will cover the services as they typically would. As always, be sure to work with your providers to assure suggested services are covered.

Does Medicare Pay for Palliative Care In Home?

Yes. While Medicare won’t refer to it as “palliative care” unless you have transitioned into hospice care, treatments that your doctor may refer to as “palliative care” are covered under Medicare’s coverage standards for in-home care.

How Long Can You Be On Palliative Care?

Palliative care outside of hospice care must meet the same standards for Medicare coverage as other care.

For example, in-home care to treat the symptoms of your illness must be fewer than eight hours a day and fewer than 28 hours a week to qualify for coverage. And a drug that is covered under Part D will still be covered, whether your doctor tells you it’s palliative care or not.

When palliative care is administered in a Medicare-approved hospice setting, the coverage shifts to follow the standards for coverage of hospice care, which initially provides two 90-day benefit periods, followed by an unlimited number of 60-day benefit periods as needed.[i]

How long will Medicare pay for palliative care?

Outside of hospice care, Medicare pays for palliative care for the same lengths of time and at the same level that it pays for other care.

Part A inpatient stays will be subject to a deductible each benefit period and daily coinsurance after 60 days.

Part B treatments will be covered — after the annual deductible — at 80 percent, with 20 percent coinsurance.

Part D drugs will require standard copays after the annual deductible.

A Medigap plan added to Parts A and B may help reduce out-of-pocket costs.

A Medicare Advantage plan that replaces Original Medicare would require out-of-pocket payments specific to the plan.

If palliative care is administered in a hospice care setting, it follows Medicare’s standards for that. Medicare-approved hospice care requires almost no out-of-pocket expenditures.

Sources

How hospice works. Medicare.gov.

This website is operated by DereneDerricotte, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.