Taking Care of Yourself: Tips and Resources for the Caregiver

Taking Care of Yourself: Tips and Resources for the Caregiver

Key Takeaways

Caregivers need to take care of themselves to take care of loved ones in their charge effectively.

Online tools like schedule planners and finance guides can help caregivers better organize and manage their responsibilities.

Respite care and support groups can help in those times when, despite all of their careful planning, caregivers feel overwhelmed.

By definition, caregiving isn’t easy.

Taking care of yourself can be a full-time job, yet caregivers often drop everything to take care of a loved one. While they wouldn’t have it any other way, caregivers need care, too

Take Time to Make a Plan

Whether you’re new to caregiving or have time in the role, finding time to get everything done for your loved one and yourself can seem impossible.

That’s why it’s essential to take time to organize and streamline things as much as possible.

Take a Look at Finances

A GoHealth survey found that 41% of Gen Xers and Millennials who helped pay for their parents’ healthcare contributed more than $10,000 in a year. That puts many caregivers in a position where they need help.

If you’re financially contributing to a loved one’s care, it makes sense to make sure they’re in the best position to help themselves. Discussing the power of attorney so you can help plan how to best use their resources for their care is an important step in establishing a successful caregiver/loved one partnership.

If you’ve reduced hours at your job or leave the job altogether to provide care, there are resources to help you make ends meet. The National Resource Center on Women and Retirement has a comprehensive guide to help caregivers.

Take Other Loved Ones Into Account

You’re likely not the only person who loves someone you care for. So as a primary caregiver — for your sake and for the sake of your loved one — it’s a good idea to get others invested in the caregiving plan.

Countless companies offer tools — many of them in the form of a handy app on your cell phone — to get others involved in the caregiving process in an organized way. As with many of the moving parts involved in caregiving, coordination is crucial to taking control.

Take a Break

Even with the best-laid plans, sometimes caregivers simply need to hit the pause button.

That’s where something called respite care can be valuable.

Respite care is temporary care that provides — well — a respite for primary caregivers. The ARCH National Respite Network and Resource Center has an interactive map to locate respite care options in your area.

Depending on where you live, financial support for respite care could be available. For example, North Carolina residents can apply for up to $500 in respite care per calendar year.

Take Care of Yourself

Your ability to be an effective caregiver can be short-circuited by your inability to care for yourself properly. Caregiving can be overwhelming and can lead to feelings that you’re in this alone, but there are resources to help.

The National Association of Area Agencies on Aging has a search tool to find support services in your area, including support groups.

Only when you help yourself can you effectively help others.

Links for Additional Caregiver Resources

A step-by-step guide to helping a loved one maximize their finances – Caring.com

A comprehensive guide to help caregivers care for their own finances – WiserWomen.org

A list of apps designed to organize the caregiving process – Caring.com

Respite care options in your area – ARCHRespite.org

Support groups in your area – n4a.org

Caregiver FAQs — ElderCare.acl.gov

How to organize a caregiving plan – HelpForCancerCaregivers.org

Sources

Caregiver Finances. Caring.com.

Financial Steps for Caregivers: What You Need to Know About Protecting Your Money and Retirement. Wiserwomen.org.

The Best Caregiving Apps of 2022: 6 Apps to Help You Through Common Caregiving Challenges. Caring.com.

Find local respite care resources. Archrespite.org.

Find Aging Resources in Your Area. N4A.org

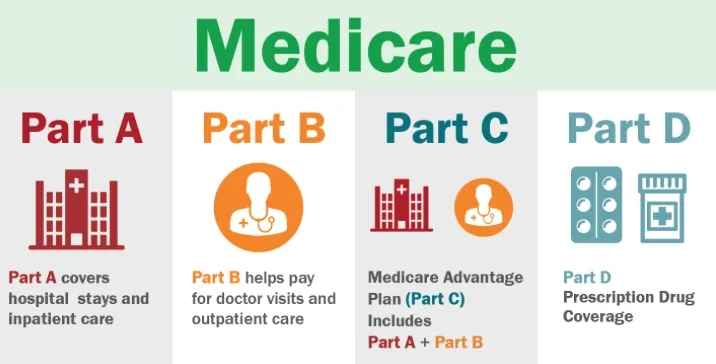

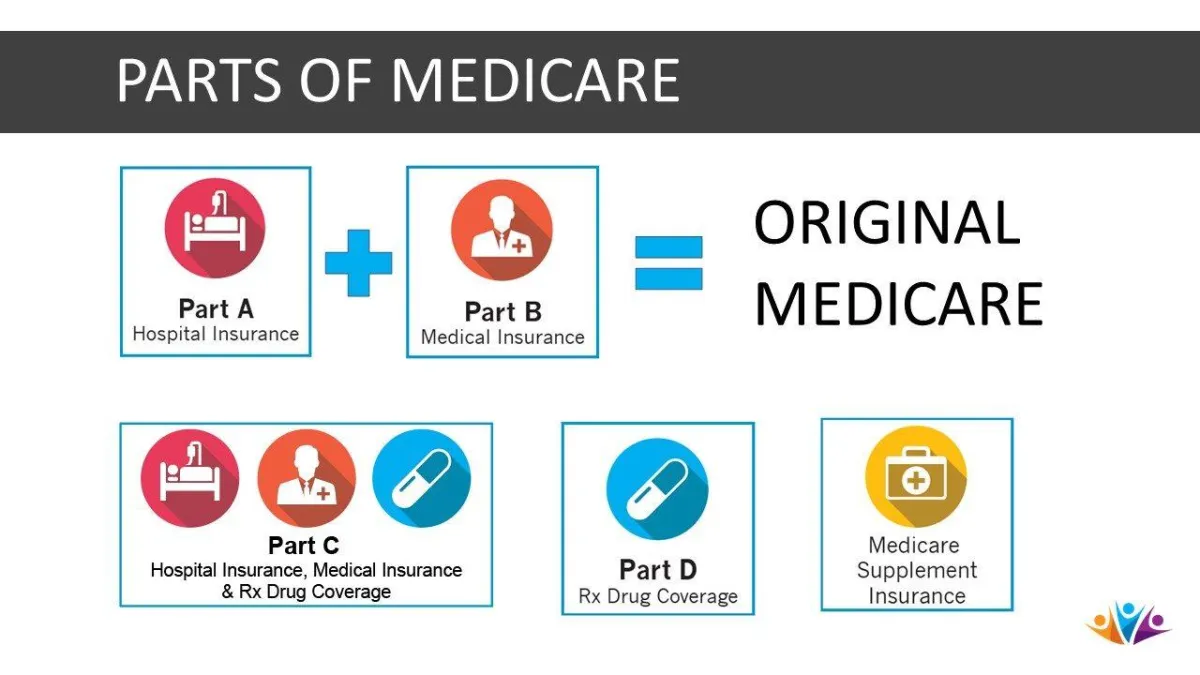

This website is operated by DereneDerricotte, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.