The Lowdown on High Deductible Health Plans

The Lowdown on High Deductible Health Plans

Key Takeaways

A high deductible health plan offers lower monthly premium payments and a higher deductible .

With a high deductible health plan (HDHP), you pay out of pocket until you reach your deductible. When you reach your deductible, you pay copayments and coinsurance until you reach your annual Out-Of-Pocket Maximum, and all approved services are covered 100%.

A Health Savings Accounts (HSA) can be set up with an HDHP.

If you don’t visit the doctor often, an HDHP offers low monthly premiums in exchange for a higher deductible. Your costs for annual preventive care are small, and you’re covered for any significant health costs after you meet the deductible. According to the CDC, it’s an increasingly popular choice — the percentage of Americans enrolled in an HDHP from 2007 to 2017 increased from 10.6% to 24.5%.

What is a High Deductible Health Plan?

High deductible health plans are health insurance policies with low monthly premiums. The insurance company can keep these payments low because the policyholder pays more for doctor’s visits and procedures and must pay out of pocket up to the deductible. After that, their costs are subject to copayments and coinsurance charges, up to the out-of-pocket maximum (OOP). Once an OOP is met, all eligible medical services are then covered at 100% for the remainder of the policy year.

Annual Deductible Limits

The Internal Revenue Service (IRS) determines the deductible and out-of-pocket limits each year. Please note that your plan’s deductible can be higher than these amounts. Your OOP, though, can’t exceed these maximum amounts.

2022 High Deductible Level

Single: $1,400

Family: $2,800

2022 Out-of-Pocket Maximums

Single: $7,050

Family: $14,100

The Pros and Cons of Having an HDHP

If you expect only preventive care appointments for a policy year, an HDHP can save you money. If you think you or a family member may need surgery, or you have injury-prone young ones, a more traditional policy with copayments may make more sense.

Pros of an HDHP

Lower premiums: HDHPs allow your health insurance coverage to be more affordable and a better fit for your budget.

Essential Health Benefits and no-cost preventive care: HDHPs offer the same 10 Essential Health Benefits and no-cost preventive services as their more expensive counterparts.

Great savings for healthy people: If you’re in good health, you may not ever come close to your deductible since you won’t spend much on doctor visits, prescriptions, or hospital stays.

Cons of an HDHP

Emergencies are expensive: If you need unexpected care, the insurance company will not pay anything until you have met your high deductible. This usually means paying thousands of dollars upfront.

Price becomes a roadblock: Paying full price discourages many customers from seeking medical attention for minor ailments. These small issues can become significant problems if gone untreated.

Location matters: If your area doesn’t have high enough participation in a company’s plans, your deductibles may be too expensive for an HDHP plan to make sense.

What do Health Savings Accounts (HSA) Have to do with HDHPs?

Many HDHP customers also enroll in Health Savings Accounts (HSA). These savings accounts pay your deductible and other out-of-pocket medical expenses. You deposit pre-tax funds from your paycheck to cover medical services and costs. Additionally, HSA funds earn tax-free interest, roll over year to year, and are yours to keep no matter if you change your job or health insurance plan. Learn more about HSA plans and how they affect your health insurance.

If you’re struggling to pay your monthly premiums–or if you’re young and healthy–you may want to consider an HDHP. These plan structures offer the same basic levels of care you’ll find with other policies, but you’ll pay less each month. If you or a loved one is shopping for individual or family health insurance plans, give us a call. We’ll walk you through your options to find a plan that works for you.

Sources

High-deductible Health Plan Enrollment Among Adults Aged 18–64 With Employment-based Insurance Coverage . CDC.gov.

Tax forms and instructions . IRS.gov.

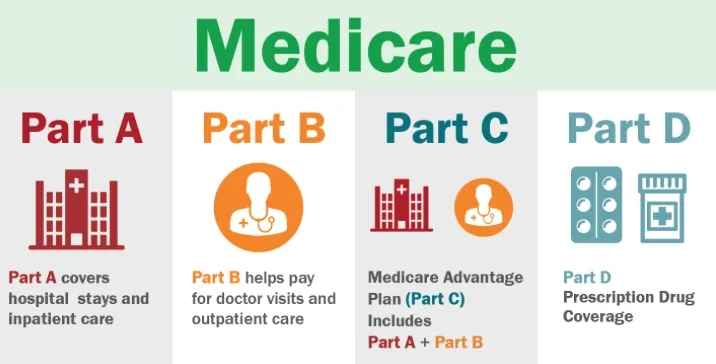

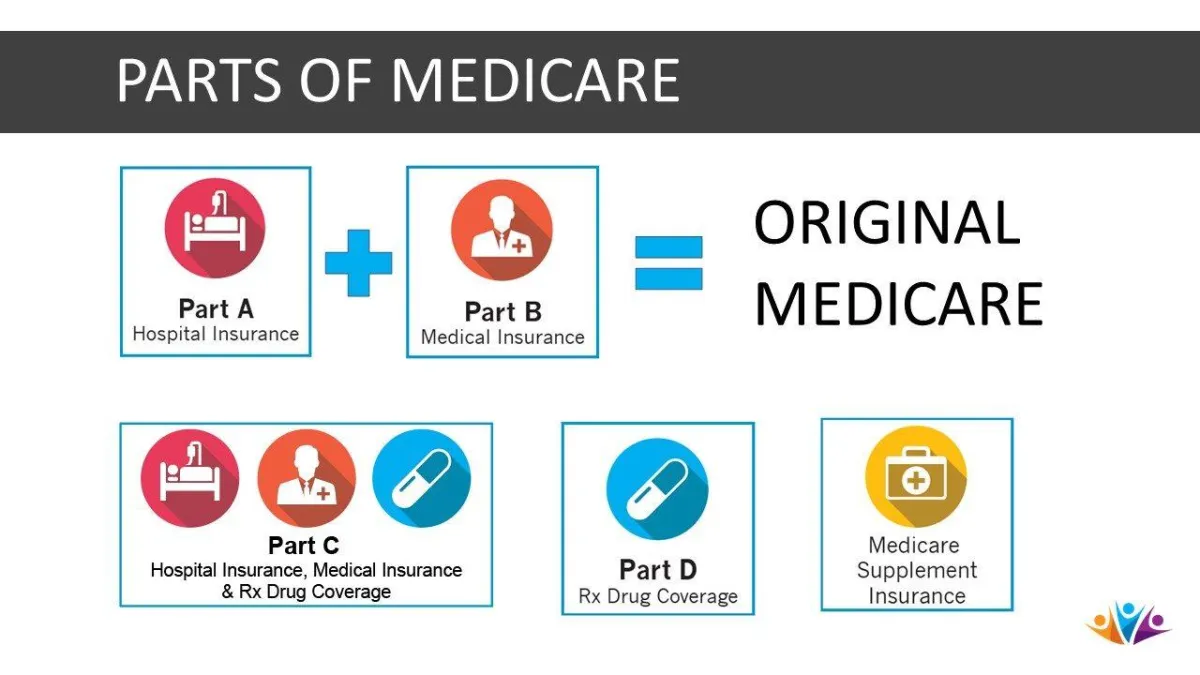

This website is operated by DereneDerricotte, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.