Benefit Basics to Help Someone Understand Medicare Health Insurance

Benefit Basics to Help Someone Understand Medicare Health Insurance

Medicare is health insurance for Americans age 65 and older. Individuals living with specific disabilities may be eligible before 65.

Medicare Advantage plans are a private insurance that combine both Medicare Parts A and B (Original Medicare). Most Medicare Advantage plans also include Part D (prescription coverage) and may have additional benefits like dental, vision and hearing coverage.

Homebound enrollees may be eligible to receive in-home care.

Serving as a caregiver is a life-changing responsibility. You can expect to experience a learning curve while you’re getting used to the care and services available to the person in your care. This overview can help shorten the curve and get you up to speed on the basics.

Where to Start? A Medicare Overview

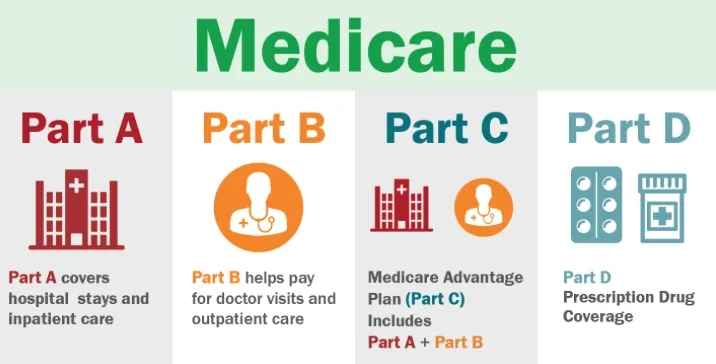

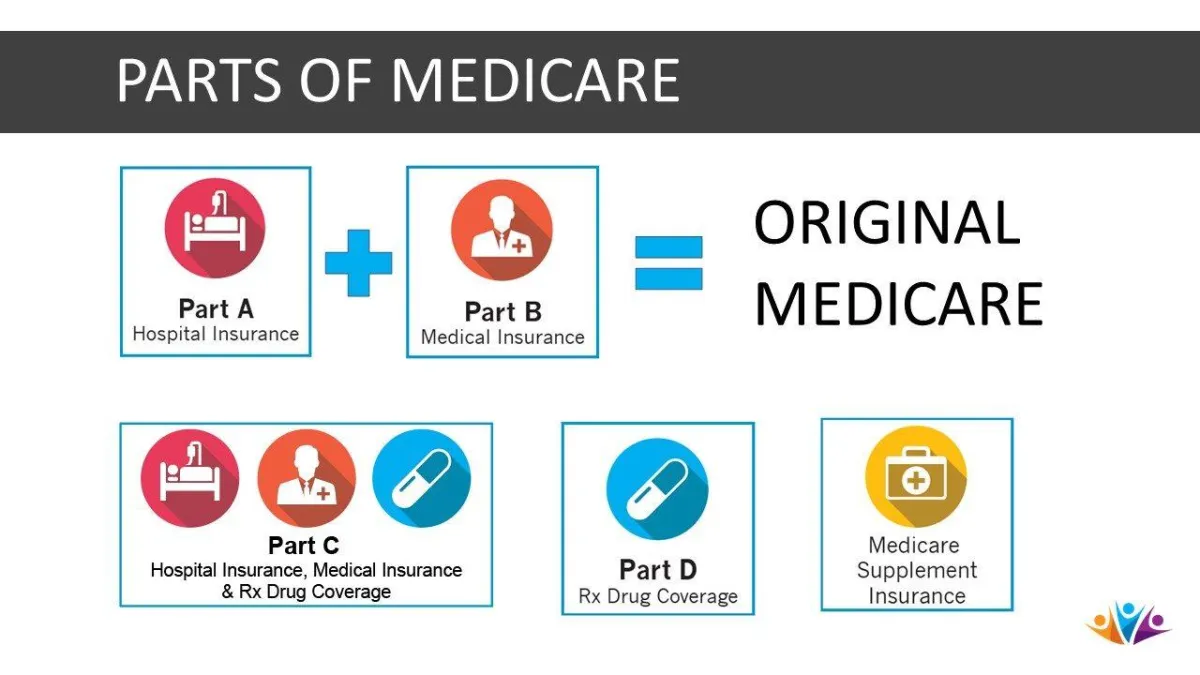

Medicare Parts A and B serve as the foundation for coverage, known as Original Medicare.

Medicare Part A: Covers hospital services.

Medicare Part B: Covers medical services.

Original Medicare does not cover all costs, so beneficiaries have the option to add coverage to fill gaps. These options include:

Medicare Prescription Drug Plan (Part D): Part D is prescription drug coverage from private insurance companies. Part D costs vary from one carrier to another and are subject to late enrollment penalties.

Medicare Supplement Insurance (Medigap): These plans are offered by private insurance companies. They exist to help beneficiaries cover coinsurance and deductibles, not covered by Original Medicare. Medigap plans have monthly premiums, and plan availability varies by state.

What Is Medicare Advantage?

Medicare Advantage (also known as Part C) plans are private insurance plans that combine Medicare Parts A and B. Most Medicare Advantage plans include Part D and may include dental, vision, and hearing coverage.

What Services Does Medicare Cover?

Medicare covers medically necessary services and preventatives services. These are what are known as Part A and B of Medicare.

Medically necessary services include:

Doctor visits

Physical therapy

Mental health

Durable medical equipment

Preventive services are usually covered at no cost and include:

Wellness visits

Screenings

Vaccines

Women’s services

Inpatient stays require an overnight stay and typically occur in three locations:

Hospitals

Rehabilitation facilities

Skilled nursing facilities

Hospital insurance is Part A. It will cover up to 60 days without coinsurance after you meet your deductible. You may have a daily coinsurance rate after 60 days.

Skilled nursing facilities and nursing homes may be covered by Medicare following surgery or an injury to the person in your care. Medicare usually covers the first 20 days.

Home healthcare must be part of a doctor’s plan of care to be eligible.

If your loved one is homebound and needs therapy (speech, occupational or physical) or skilled nursing care, they may qualify.

What Is Hospice and Palliative Care?

Hospice prepares a patient for the end of their life rather than treating a terminal illness. Hospice is holistic care, including but not limited to symptom management, social services, and home service. Hospice requires a life expectancy of six months or shorter, unless there are exceptional circumstances.

Palliative care is the treatment to manage daily life with a severe illness. The care is for physical, mental and emotional pain after a heartbreaking diagnosis. Treatment must be in relief of a terminal illness to be covered by Medicare.

Sources

What does Part B of Medicare (Medical Insurance) cover? HHS.gov.

Inpatient hospital care . Medicare.gov.

Home health services . Medicare.gov.

Hospice care . Medicare.gov.

This website is operated by DereneDerricotte, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.