Switching to Medicare Advantage Plans From Original Medicare

Switching to Medicare Advantage Plans From Original Medicare

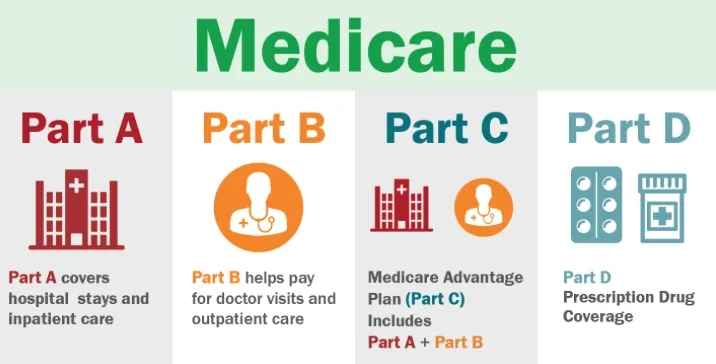

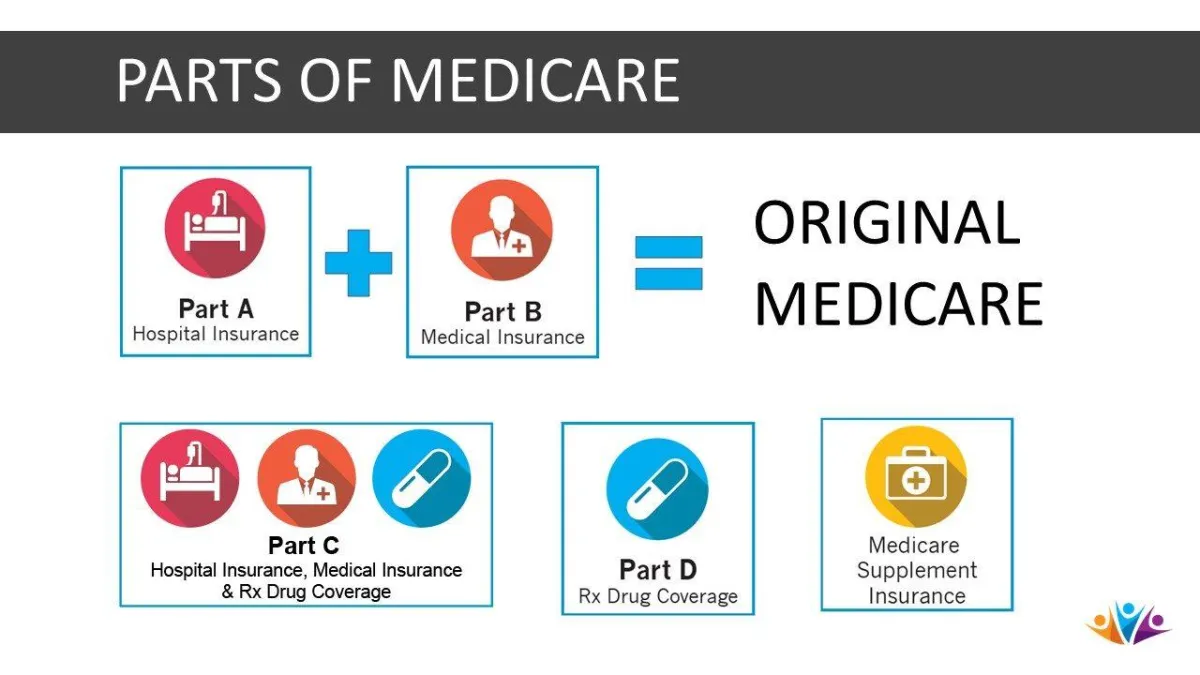

Medicare Advantage plans are sold by private insurance companies and offer at least the same coverage as Original Medicare .

Every plan is different. There is a wide variety of Medicare Advantage plans depending on where you live and how much you want to spend.

How much do you need? Select a plan based on your current and future healthcare needs.

Plan your switch. You can only switch to a Medicare Advantage plan, or from one plan to another, during certain times of the year.

If you have Original Medicare and want to switch to a Medicare Advantage plan, you’ve probably considered the pros and cons of each. If you’ve made up your mind, you may have other questions. When can I enroll in a Medicare Advantage plan ? Are there certain times for Medicare Advantage enrollment ? You may even be wondering who can enroll in Medicare Advantage.

Need answers? Here is what you need to know about switching to Medicare Advantage.

Can I Sign Up for Medicare Advantage at Any Time?

If you’re thinking about switching to Medicare Advantage (Part C), you’ll need to know when to enroll in Medicare Advantage plan choices in your area. There are certain periods throughout the year when you can sign up for, or switch between, Medicare Advantage plans. These are called enrollment periods. Some are scheduled periods, but some can be opened due to special circumstances.

When can you enroll in Medicare Advantage plans ? These are known as enrollment periods, and they include:

Open Enrollment Period (OEP), also known as Annual Enrollment Period (AEP)

Medicare Advantage Open Enrollment Period

Special Enrollment Periods

You can also choose to sign up for a Medicare Advantage plan during your Initial Enrollment Period. This period includes the month you turn 65, plus three months before and after. Once you’ve enrolled in Parts A and B, you can switch over to Medicare Advantage.

When Is It Too Late to Sign Up for a Medicare Advantage Plan?

It’s never too late to sign up for a Medicare Advantage plan. Original Medicare, though, carries penalties that will be added to your premiums if you don’t sign up when you are first eligible.

You should sign up for Original Medicare when you are first eligible — at age 65 or with a qualifying disability. If you decide to wait, you could face late enrollment penalties. These are calculated using the amount of time that passed between when you were first eligible and when you finally signed up. Worse, some last as long as you have your plan. There are different late penalties for Parts A, B and D (If you worked 10 or more years, you won’t have to pay a Part A premium and therefore won’t pay a penalty).

If you sign up for a Medicare Advantage plan after you have incurred a penalty for late enrollment, this penalty will typically carry over to your Medicare Advantage plan. Some Medicare Advantage plans may cover your Part B premium. If they don’t, you will have to pay the premium plus your penalty each month, in addition to whatever your Medicare Advantage plan’s premium is. Some Medicare Advantage plans offer no-cost premiums.

How Long Do I Have to Enroll in a Medicare Advantage Plan?

If you’re looking to sign up for a Medicare Advantage plan when you’re first eligible, your enrollment window opens the same time as your IEP — three months before the month you turn 65. Once you enroll in Parts A and B, your first chance to enroll in Part C ends when one of two things happens (whichever comes last):

You reach the last day of the month before your Parts A and B coverage start.

You reach the last day of your seven-month Initial Enrollment Period.

Each year, there’s a nearly six-month period that features a pair of other enrollment periods for Medicare and Medicare Advantage. These include the Open Enrollment Period (October 15 to December 7) and the Medicare Advantage Open Enrollment Period (January 1 to March 31).

When Can I Switch My Medicare Advantage Plan?

You can switch from one Medicare Advantage plan to another during both OEP and the Medicare Advantage Open Enrollment periods. Additionally, you may meet the criteria for a Special Enrollment Period any time on the calendar. A few examples include:

You move to an area outside of your current plan’s coverage.

You move to an area within your current plan’s coverage area, but you now have additional coverage options.

You move back to the U.S. after living abroad.

You move in or out of a long-term healthcare facility or hospital.

You are released from jail.

You lose your Medicaid coverage but are eligible for Medicare.

You have a chance to enroll in an employer-based insurance plan.

Medicare ends its contract with your current Medicare Advantage plan.

Medicare takes action against or sanctions your Medicare Advantage plan because of a problem.

You become dual eligible for both Medicare and Medicaid.

Fall Open Enrollment Period

The Medicare Open Enrollment Period (OEP) is also called the Annual Enrollment Period (AEP). It’s held each fall from October 15 to December 7. During this period, you can sign up for a Medicare Advantage plan, switch from one plan to another, or drop your plan.

Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period is an enrollment period that is set up specifically for people who are already enrolled in a Medicare Advantage plan. During this period, you can switch from your current plan to another plan, or drop your Medicare Advantage plan and return to Original Medicare. The Medicare Advantage Open Enrollment Period runs from January 1 to March 31.

Special Enrollment Periods

Special Enrollment Periods (SEP) are signup periods that you are granted because of a special circumstance like a move to a new city or a change in your eligibility. SEPs run different lengths of time depending on the specifics of your situation.

Sources

Joining a health or drug plan. Medicare.gov.

Special Enrollment Periods. Medicare.gov.

This website is operated by DereneDerricotte, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.