All About Medicare Supplement Insurance (Medigap) Coverage

All About Medicare Supplement Insurance (Medigap) Coverage

Key Takeaways

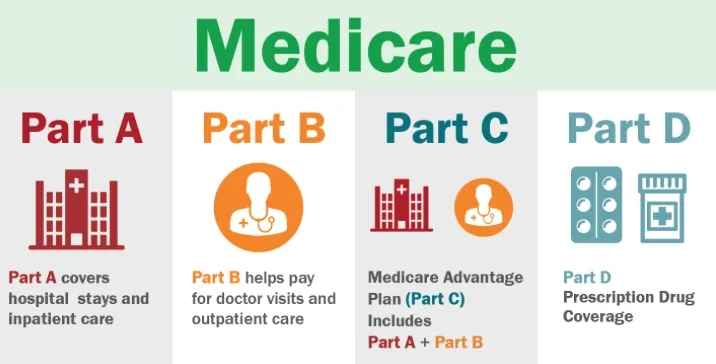

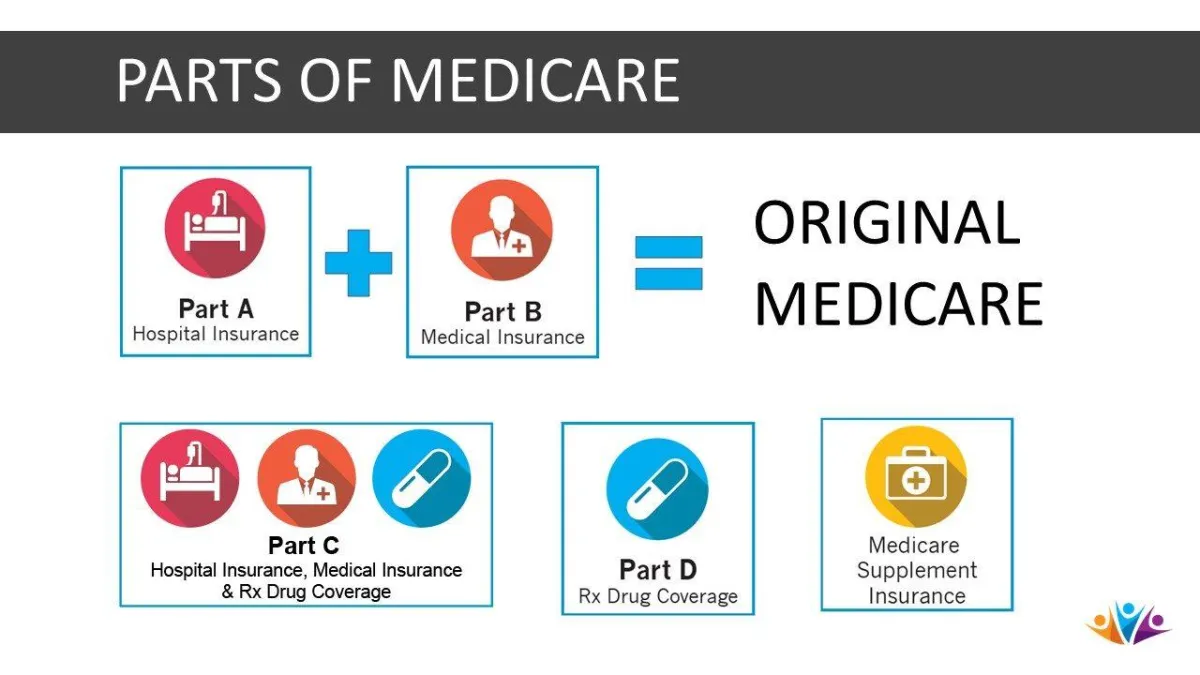

Medicare Supplement Insurance (Medigap) is extra insurance that you can purchase in addition to Original Medicare (Parts A and B) .

Medigap guards Original Medicare enrollees against costly copayments , deductibles and coinsurance from certain medical treatments or lengthy hospital stays.

Medigap plans sold with Medicare policies do not cover the Part B deductible.

Whether you’re new to Medicare, or you’ve been a customer and are looking for more coverage, you may have noticed some gaps between your needs and what’s covered by Original Medicare. These gaps include coinsurance and copayment charges that can be expensive for most people. Medicare Supplement Insurance (Medigap) is a set of health insurance policies, sold by private insurance carriers, that cover these needs.

Medigap coverage typically offers:

Different coverage levels with standard benefits for each plan.

A range of services and plans, each assigned with a letter from “A” to “N.”

Medicare Supplement Insurance (Medigap) is only available to those enrolled in Original Medicare; it’s illegal for someone to sell you Medigap coverage if you’re enrolled in Medicare Advantage. Some plans have different benefits than others, but basic coverage is the same across most states and insurance companies. Each Medigap plan is required to follow federal and state laws to protect you and your policy.

What’s Covered?

Not everyone will–or should–choose the most comprehensive option. When the time comes to make your choice, it’s important to know what is, and isn’t, included in each plan option.

Medigap plans are identified alphabetically from “A” to “N”, (though plans “E”, “H”, “I” and “J” are no longer sold). Plan A provides the most basic coverage, while Plan F is the most comprehensive.

Each plan has different levels of coverage, but federal law requires all Medigap plans to offer equal basic healthcare services. The decision to provide additional benefits is made on a state-by-state basis. It’s important to know which plans your state offers, as not all states offer all ten supplemental plans. Here’s a breakdown of what each Medigap plan covers.

All Medigap policies cover at least a portion of the following services:

Medicare Part A coinsurance and hospital costs

Medicare Part B coinsurance and copayments

The first three pints of blood

Part A hospice care coinsurance and copayments

Is there anything Medigap doesn’t cover?

While Medigap has several plans and coverage levels, you can’t buy a policy that covers the following:

Long-term care

Vision

Eyeglasses

Dental

Hearing aids

At-home or private-duty nursing care

Customers that need these services can opt for Medicare Advantage instead of Original Medicare. Medicare Advantage, or Medicare Part C, is also sold by private insurers and offers more comprehensive coverage.

Important Notes About Medigap Coverage

As of January 1, 2020, Medigap plans sold with Medicare policies can not cover the Part B deductible. Plans C and F are not available to new enrollees joining Medicare on or after that date. Enrollees eligible for Medicare before January 1, 2020, but who have not yet enrolled, may be able to buy one of these plans.

Customers that are new to Medicare and want a comprehensive plan similar to Plans C and F may want to consider Medicare Plan G coverage because it pays for most copayments and coinsurance.

Sources

Find a Medigap policy that works for you. Medicare.gov.

How to compare Medigap policies. Medicare.gov.

What’s Medicare Supplement Insurance (Medigap)? Medicare.gov.

This website is operated by DereneDerricotte, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.