What Is Coinsurance?

What Is Coinsurance?

Key Takeaways

Coinsurance is a percentage of a medical cost split between you and your insurance company.

The coinsurance rate varies depending on your health plan. Typically, your coinsurance can be lower if you pay a higher monthly premium .

What is Coinsurance?

Coinsurance is a cost-share between you and your health insurance company. The rate is a percentage of a total medical bill split between you and your insurer. For example, your insurance plan may cover 80% of the cost, while you’re responsible for the remaining 20%.

You are usually required to pay coinsurance costs after you’ve met your deductible and before you’ve reached your out-of-pocket maximum amount. Coinsurance generally applies if you select doctors and hospitals within your health plan’s network. Costs could be higher if you use out-of-network healthcare providers.

How Does It Work?

Here’s an example of when coinsurance rates may apply:

Deductible: $1,000

Coinsurance: Insurance pays 80%, while you pay 20%

Out-of-pocket Annual Maximum: $3,000

Let’s say you were sick with the flu at the beginning of the year, and admitted to the hospital. Your stay cost $1,000. You’ll pay the full $1,000 to reach your deductible.

In the same year, you broke your leg. This time, your bill is for $2,500. Because you met your deductible earlier in the year, you’re only responsible for 20% of the bill until you reach your out-of-pocket maximum.

Here’s the cost breakdown:

Total medical bill: $2,500

Your health insurer pays 80%: $2,000

You then owe 20% of coinsurance: $500

After two hospital visits, you’ve paid $1,500 of your out-of-pocket costs for the year. Your coinsurance costs (20% for you and 80% from your insurance plan) will continue until you’ve reached your out-of-pocket limit of $3,000.

What’s the Difference Between Coinsurance and Copays?

Coinsurance and copays are two different ways insurance companies pass on service costs to you. Generally speaking, a copay is a flat rate you pay at the time of service for care, and it applies immediately. Coinsurance usually begins after you have met your deductible.

To explain, here’s an example:

When you visit the doctor, you pay a flat rate called a copay. For example, while a primary care visit may cost $180, you only pay your copay amount for the visit. If your copay for a primary care visit is $20, you pay $20 instead of the $180.

Coinsurance is a percentage split in the cost between you and your insurance company. This takes effect after you’ve met your deductible. For example, if your deductible is $1,000, you pay 100% of your costs until you reach $1,000. After you reach $1,000, you may only be responsible for 20% of your costs (if your plan has an 80/20 coinsurance). This means, after your deductible, you pay 20% and insurance pays 80%.

To explain, let’s use an easy example. If you have a $20 copay and 80/20 coinsurance for a doctor visit that costs $180:

Your copay would be $20

Your coinsurance would be $180 before your deductible is met, and $36 after your deductible is met

Sources

The ‘metal’ categories: Bronze, Silver, Gold & Platinum . HealthCare.gov.

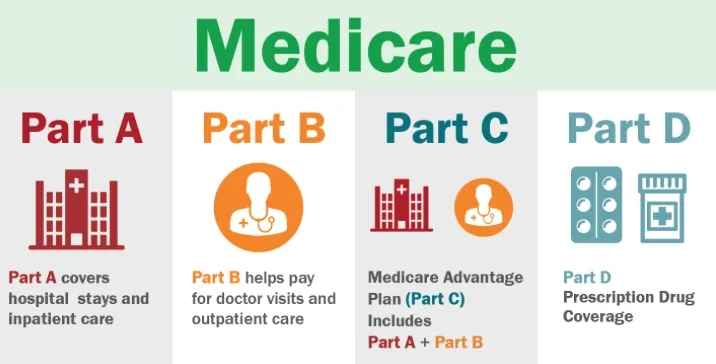

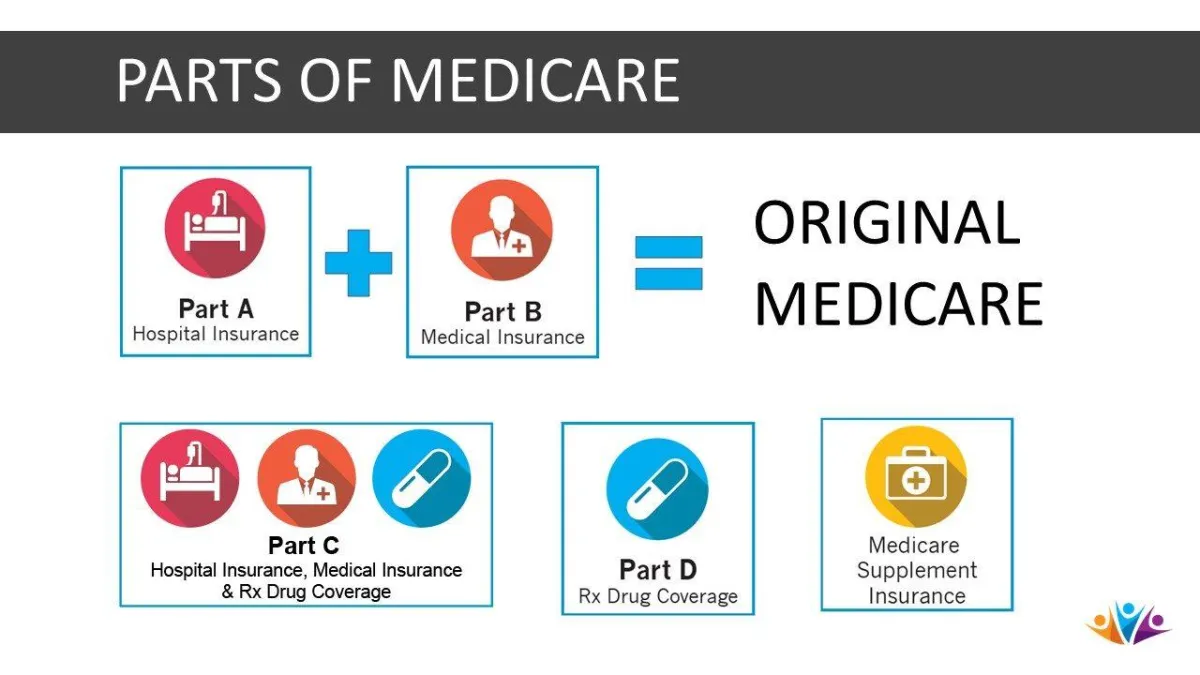

This website is operated by DereneDerricotte, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.