Your Health Insurance and Healthcare Costs Explained

Your Health Insurance and Healthcare Costs Explained

Key Takeaways

Your health insurance costs vary based on your plan’s cost-sharing and your healthcare needs.

Most health insurance plans allow you to receive preventive care for zero cost or a small copay.

In-network services are always going to cost the least, so know your plan’s network .

If you have daily Rx needs, ensure your plan’s drug formulary includes your prescription.

What Does Your Health Insurance Cost?

Your out-of-pocket costs for health insurance can vary based on several factors. Rising or decreasing health insurance costs depend on the type of health coverage you select, your plan’s premiums, deductibles and out-of-pocket maximums. Your insurance costs also factor into whether you qualify for a subsidy through the Affordable Care Act (ACA) or if you have a group plan or individual plan.company. You get access to the company’s pharmacy network and pay a copay for prescriptions.

What Does Your Healthcare Cost?

Your healthcare costs depend on the services you need during your plan’s calendar year. Most insurance plans cover wellness exams and preventive care, meaning these doctor visits and services could cost you zero dollars. If you need diagnostic services, like lab tests, you may be required to cover copays or deductibles. Without insurance, a primary care visit could cost you anywhere from $100 to $200.

Understand the Cost of Your Care

It’s important to ask questions about your care and know what you can expect for healthcare services. Many plan options have increased the level of cost-sharing to encourage better decisions for preventive care and health and wellness. You and your health insurance provider share the costs of care through premiums, deductibles, and copays.

Provider networks linked to your coverage can also change your costs. Your plan’s network should include the providers you want to see for your care. Once you know you’re covered in-network, it’s a good idea to know what it costs to see a provider out of network. An in-network provider visit will always cost less than seeing a provider outside of your plan’s network.

Understand the Cost of Your Prescription Drugs

Prescription drug costs can vary, and the range of value can depend heavily on whether a drug is generic or name-brand. Insurance companies use prescription drug formularies and drug tiers to determine available medications. Low tiers are usually the lowest cost, and costs increase when the drug tier increases. Be sure to ask about your plan’s formulary and pharmacy network to ensure your prescription is included. You may also save money by asking your doctor if a generic brand is available for any of your prescriptions.

How to Get the Right Plan for You

Before you choose any plan, know what you can afford and the type of care you may need. It’s important to ask questions about your plan’s networks and costs, like:

Is your preferred provider in-network?

Does the plan’s formulary cover your prescription?

What is your premium, deductible, copay and coinsurance cost?

What hospitals and specialists are in-network?

These questions will help you plan for your care and your cost and reduce any unexpected costs.

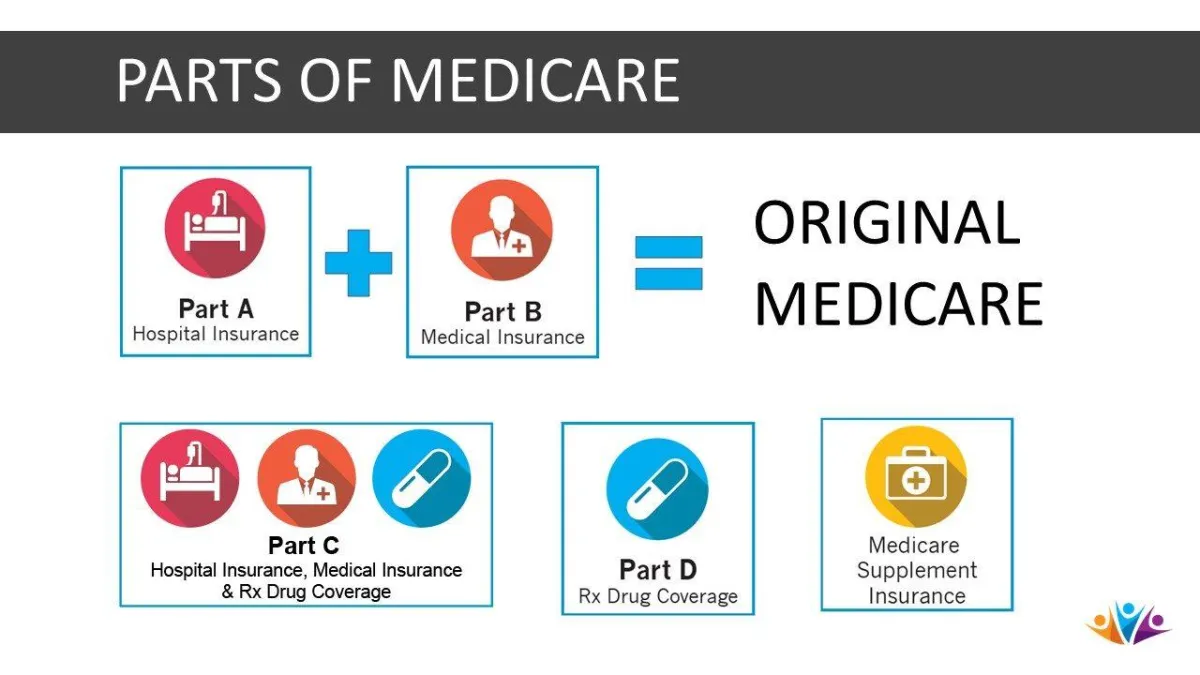

This website is operated by DereneDerricotte, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money.

Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.